Jan 2, 2025

As the financial sector continues to evolve, the integration of artificial intelligence (AI) is no longer a futuristic concept but a present-day reality driving significant transformation. At Katipult, we are committed to staying at the forefront of this innovation, and our recent project validation engagement with the Alberta Machine Intelligence Institute (Amii) underscores this commitment.

Oct 24, 2024

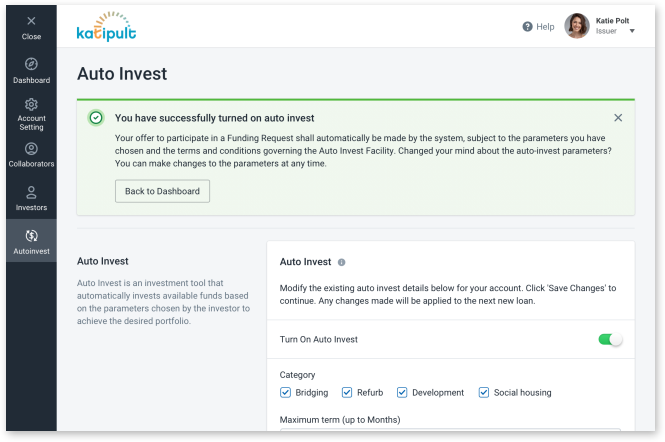

The financial industry is rapidly evolving, and in the coming years we expect artificial intelligence (AI) will further revolutionize the capital markets, providing efficiencies and enhancements that were previously unimaginable. At Katipult, we are at the forefront of this transformation, leveraging some of the greatest minds in the field of AI to study how to further streamline and improve the investor experience. Here, we explore 5 possible application areas of AI:

Oct 21, 2024

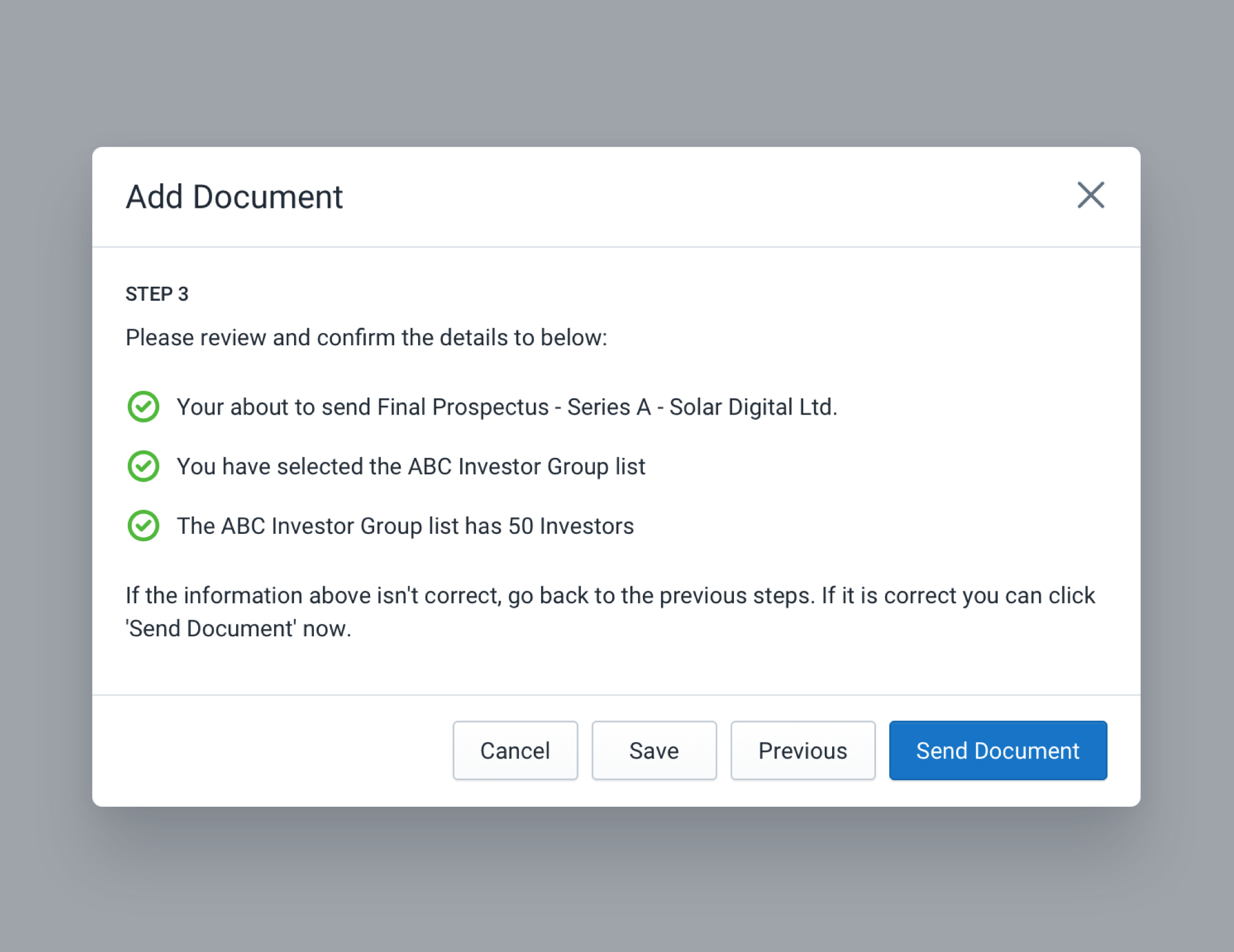

In today’s fast-paced financial landscape, efficiency and precision in managing public investment offerings are paramount. Katipult’s latest DealFlow release is tailored to meet these demands, offering enhanced capabilities that transform the way financial services firms handle syndication, investor engagement, and ticketing.

Aug 5, 2024

As financial advisors navigate an increasingly complex investment landscape, leveraging advanced software solutions is crucial. Katipult DealFlow stands out by streamlining critical investment workflows including private placements and prospectus offerings, but leveraging complementary software can further enhance its capabilities. Here are five key solutions that can transform your advisory services:

Jul 29, 2024

As the economy continues to evolve, certain industries are set to lead in capital raising, attracting significant investor interest. For registered broker-dealers, identifying these key sectors is crucial for strategizing and advising clients. Here are the top three industries expected to raise the most capital in the next two years:

Jul 22, 2024

Family Offices are experiencing a significant boom, driven by the need for personalized financial management and alternative investment strategies. With this growth comes the necessity for improved operational efficiency and preparedness for unforeseen circumstances, such as the sudden inability of a primary manager to continue their role. Utilizing advanced software solutions to engage with Family Offices can revolutionize how Family Offices participate in your deals.

Jul 15, 2024

In the fast-paced world of capital markets, leveraging technology to enhance investor relationships, improve experiences, and streamline processes is crucial. An investor CRM is one of the most important systems that can elevate your capital raising efforts. Here are the top five reasons why integrating an investor CRM can transform your fundraising strategy:

Mar 1, 2024

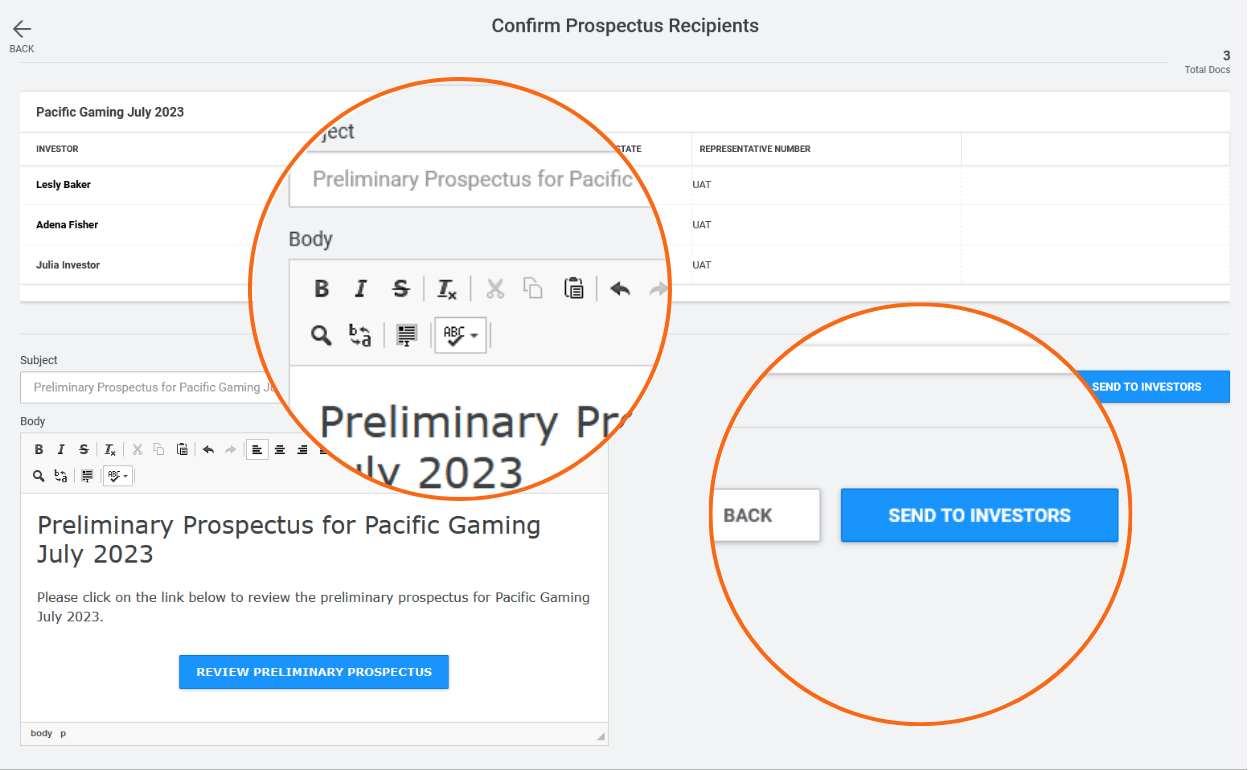

For years, investment dealers have had to bear the burden of distributing preliminary and final prospectuses to investors for public offerings. In addition to the costs associated with printing and mailing these documents, investment dealers must log final iterations of a prospectus. There is also administrative effort for Investment Advisors, who are responsible for sending their clients any amendments to preliminary or interim prospectuses.

Feb 20, 2024

Attracting investors to private deals requires a holistic approach that addresses their investment preferences, risk tolerance, and liquidity needs. By implementing these five strategies and incorporating actionable insights for each, Investment Advisors can effectively position private offerings as attractive investment opportunities in a competitive market environment.

Feb 13, 2024

Significant changes are underway in fund administration, fueled by the convergence of technological advancements and the ever-evolving expectations of investors. This journey extends beyond a mere checklist of trends; it's a compelling narrative of adaptation and innovation that fund managers must intricately weave into the fabric of their daily operations.

Feb 5, 2024

A recent Preqin report looking at trends for the year ahead highlighted the importance of technology for private equity firms in 2024.

Jan 26, 2024

As with many alternative asset classes, many analysts are hopeful that as the macroeconomic landscape changes in 2024, growth in private equity funds should start to rebound after a turbulent couple of years.

Jan 22, 2024

Staying ahead in private equity requires strategic innovation. One such transformative strategy gaining traction is the concept of "lift-outs." In this piece, we delve into the nuances of lift-outs and their inherent benefits and provide a hypothetical scenario to illustrate how this strategic maneuver can reshape the operational landscape of private equity firms.

Jan 17, 2024

2023 was a year marked by economic uncertainties and challenging market conditions, yet Katipult’s customers leveraging its proprietary DealFlow platform demonstrated remarkable resilience and growth in many key capital raising metrics.

Dec 8, 2023

Capital Environment Changes Drive Imperative for Financial Institutions to Adapt.

In recent years, a seismic shift has been underway in the investment landscape, with private capital markets emerging as the dominant force for industry growth. The traditional appeal of public markets faces competition from a growing preference for private investments from investors and issuers, signalling a long-term trend that could see public markets wane in significance over the next 5 to 10 years.

Dec 4, 2023

Broker-dealers are increasingly drawn towards cross-border deal-making, particularly on private deals between the United States and Canada. Navigating this terrain poses unique challenges and opportunities, demanding a comprehensive understanding of the intricacies involved. In this article, we'll delve into the critical considerations for broker-dealers venturing into US/Canada new issue deals.

Nov 30, 2023

Katipult CEO Gord Breese spoke with Coreena Robertson from Stockhouse as part of their Watchlist videos to discuss what the results represent for the company and shared some details for expectations for the future.

Nov 13, 2023

In recent years, Special Purpose Acquisition Companies, or SPACs, have taken the financial world by storm, capturing the attention of both investors and investment professionals. These unique investment vehicles have gained prominence in North America as a popular and innovative way for companies to raise capital on public exchanges.

Nov 6, 2023

Sustainable investing has transformed from a passing trend to a pivotal consideration for investment firms and broker-dealers. The ascent of Environmental, Social, and Governance (ESG) criteria is reshaping investment strategies and influencing the financial landscape.

Oct 23, 2023

Understanding prevailing trends is crucial in the investment and mergers and acquisitions (M&A) landscape. A recent survey, “The 2023 Trends in Investing,”’ conducted by the Financial Planning Association (FPA), has unveiled insights into the changing dynamics of alternative investments and the state of global M&A. Additionally, research from the Alternative Investment Management Association (AIMA) sheds light on emerging trends in private credit that align with the survey findings.

Oct 17, 2023

The annual ADISA conference in Las Vegas is always an excellent opportunity to catch up with sponsors, managing brokers and other stakeholders in the alternative investments industry. The conference also had some insightful educational tracks highlighting several challenges we are actively focused on solving for our customers with Katipult DealFlow.

Sep 27, 2023

On August 23, 2023, the U.S. Securities and Exchange Commission (SEC) announced a momentous change to the $20 trillion private fund industry. The SEC unveiled a sweeping set of reforms aimed at reshaping the landscape of this segment of the alternative investments sector. These regulatory changes carry far-reaching implications for broker-dealers, private fund managers, and investors.

Sep 11, 2023

There has been an increasing trend of private equity real estate sponsors and fund managers embracing technology such as investment platfoms to expand their digital capabilities and distribution channels. An overarching theme of these initiatives is to enhance accessibility for investors and financial advisors to buy, own, and sell real estate investments online.

Sep 1, 2023

Wealth Management is rapidly transforming as securities deregulation, disintermediation, investor demographics, technology, and accessibility to new investment products drive fundamental changes to the industry. As these changes accelerate, financial advisors have to deliver strategies that justify fees and provide a differentiated service for their clients otherwise, they risk losing business to low-cost, self-administered brokerage accounts, robo advisors, and the growing number of ETF options.

Aug 17, 2023

Institutional investors stand as formidable pillars, commanding vast pools of capital and exerting a profound influence on global capital markets. These sophisticated and well-funded entities, including pension funds, insurance companies, sovereign wealth funds, and endowments, are pivotal in shaping economies and businesses' trajectories.

Jul 26, 2023

In 2019, both Capital One and Empire Life experienced data breaches where cybercriminals gained unauthorized access to systems containing the personal information of over 100 million clients. A few years earlier, in 2014, JPMorgan Chase experienced a significant data breach. Hackers accessed the bank's systems and compromised the personal information of approximately 83 million customers.

Jul 24, 2023

As deal activity within capital markets increases, ECM teams are refining processes and upgrading their technology including investment platforms, positioning them to maximize the volume of deals they can run.

May 15, 2023

In the realm of alternative investments, private placements have emerged as an option for businesses seeking to raise capital and for investors looking for enhanced returns. The agility of a private placement combines the interests of investors and issuers, fostering a symbiotic relationship.

Apr 17, 2023

As a leading voice in the digital transformation of the alternative investment sector, we keep a close eye on trends and patterns that we see emerging. We sat down with Katipult CEO Gord Breese for a Q&A across three broad themes we expect to be notable trends this year; Compliance Changes, Technology, and Investor Demographics.

Hi Gord, and thanks for your time today. As we outlined, we want your thoughts on a few key themes and topics that we expect to be of interest to the investment community this year and into 2024.

Firstly we want to discuss the impact you expect over the coming years from the compliance changes that have recently been introduced.

I’d like to start with some of the regulations around solicitation capabilities. Although Reg 506(B) & Reg 506(c) are well established, please share your thoughts on how investment marketing might evolve for private investments.

The regulations around how investments can be marketed have generally restrictive, meaning broker-dealers and sponsors have had to follow relatively rigid processes to comply with investor solicitation rules. For that reason, we saw many of those organizations constrained in their ability to add new investors to their networks and communities, with most of that growth coming in the form of referrals from existing investors. The rules surrounding solicitation–Reg 506(b), Reg 506(c) and Reg A+ –were introduced in 2013, and in response, investment dealers are now using technology and digital marketing tools to attract and educate investors on investment opportunities.

What sort of impact will this have on investment banks and dealers?

Under Reg 506(c), these firms can offer and sell securities to an unlimited number of accredited investors. Under Reg 506(b), perhaps more crucially, they can sell shares to up to 35 non-accredited investors who meet certain financial sophistication requirements. The investment dealer must take reasonable steps to verify that the investors are accredited or meet the financial sophistication requirements. Still, the possibilities for marketing new deals are very exciting because soliciting new investors is now allowed.

As a platform that supports private placements, how will this impact Katipult’s customers?

For our customers looking to take advantage of 506(c), we are introducing new capabilities such as DealFlow Marketing. This will enable Equity Capital Markets teams and Financial Advisors to quickly and easily share deal information with a broader pool of investors, enabling more people to participate in new and innovative investment options. We’re excited by this as it aligns with our mission to make private placements more accessible

Moving onto the next topic, what can you tell us about Real-Time Suitability, AML & KYC Checks

Regulators are increasingly comfortable with new ways to resolve redundant and tedious tasks for investors, including suitability and know-your-client (KYC) checks. As a result, there have been increases in the access and use of trusted and reliable data sources which allow for comprehensive approvals on investors in literally seconds. In addition, we’ve worked with our customers to integrate several of these new, fully digital services into Katipult DealFlow, vastly reducing the time it takes to add and set up new investor accounts.For our customers, this means they can onboard new investors faster, leading to an overall more efficient workflow and process.

My final question on compliance; how will some of the newer regulations, such as Reg A+ or Reg A Tier 2, increase investor participation?

Regulators have historically been wary about facilitating wider retail investor participation in private placements. As a result, many high quality deals were limited to institutional investors and high-net-worth individuals. Tier 2 of Reg A has changed that significantly and opened up investor participation for capital raises of up to $75 Million for all investors. There are still some restrictions, and issuers and sponsors need to get approval from the SEC; but, under Reg A+, investors don’t need to be accredited to participate.

Thanks, Gord. Moving into technology, what are some significant themes that you think we’ll see in the coming year?

I don’t think we can talk about trends in technology without touching on AI. Since ChatGPT and other generative AI tools exploded into the mainstream at the end of last year, AI has been elevated across public consciousness.

While we are adopting AI as part of the tools we use to develop our software, the really interesting trend will be how AI out in the long run across Capital Markets. As with other sectors, AI will likely offer significant advantages by making task-orientated work more efficientl, enabling us to focus on making more higher value nuanced decisions.

As adoption becomes widespread, the more interesting use cases will come with AI assisting on more abstract problems. Areas of interest for Katipult are issuer due diligence, syndication management, and how to engage investors the investment process.

What is your perspective on how that might align with another important tech topic; Big Data?

I think we’ll start to see organizations that have adopted the use of data as a strategic resource –those that collect and manage their investment activity and transaction data and pay careful attention to how its structured–are in a much stronger position to use AI to mine and analyze this data, and capture powerful and valuable insights. Using AI with their data assets will give them a long-term strategic advantage over their competitors.

That sounds interesting. What sort of impact could this have?

The key to leveraging Data and AI is rooted in how firms can improve their core business processes and customers' experiences. For example, Financial Advisors will be able to help individual clients achieve their investment mandates and provide highly tailored investment solutions based on preference and previous transactions.

Alongside Big Data and AI, what other technology trends do you expect to be significant in the next 12 months?

We see continued advancement in workflow automation and Smart Messaging. This aligns with the potential of AI to create efficiencies in peoples’ day-to-day work, where tech is increasing productivity by automating processes and tasks, allowing them to focus on the more critical, elements of their jobs.

Smart messaging–leveraged with the data strategies we’ve already discussed–will deliver powerful capabilities that users are alerted about actions and issues that require their attention and prompt them to act in real time.

Turning to our third theme, investor demographics, what can we expect to see in the near future?

One of the most relevant trends for private markets is the growth of the accredited investor category. On August 26, 2020, the SEC revised the accredited investor definition to include individuals with particular professional certifications, designations, or other credentials as "knowledgeable employees" of private funds. By making these changes, the SEC effectively increased the number of accredited investors in the US by a multiple of 10.

Family Offices are also growing, adding to the number of accredited investors.

So it sounds like more people will be able to participate in private placements. Presumably, this will mean an increase in the amount of capital being invested?

Absolutely. In the past, private investment opportunities were limited to accredited investors for compliance reasons. Investment firms compete for these investor dollars, so the increase in the number of accredited investors creates significant opportunities in the industry.

Interestingly, the expanded eligibility of accredited investors is happening concurrently with the largest intergenerational transfer of wealth as baby boomers pass assets to their younger family members.

This demographic bubble is the wealthiest generation in history. It is estimated that between $30T to $68T will be transferred in the United States alone. In addition, we also see that investors are increasingly seeking alternative investment options for their capital. Both trends will result in an enormous influx of capital into private markets.

Ok, we’re talking staggering amounts of money potentially coming into private markets? So how will firms be able to attract investment and tap into that?

As we touched on earlier, one of the ways we will see is much more aggressive marketing of deals by firms under regulation 506(c).

The regulation isn’t new; it has existed since being introduced as part of the Jumpstart Our Business Startups (JOBS) Act of 2012. However, investment dealers seem to have struggled to implement systems to market private placements to qualified investors, despite expectations from investors for quality digital solutions.

This is one of the reasons why we’re developing DealFlow Marketing. This module enables firms to quickly and easily pass on investment information to relevant parties at speed and scale.

Thanks, Gord. This conversation has been great and provides plenty to consider for the months ahead.

Apr 6, 2023

We’re pleased to share that Katipult has been selected as a finalist for the Banking Tech Awards USA 2023. The event–organized by Fintech Futures–recognizes excellence across all aspects of banking tech within the United States. As we continue to expand our global footprint, we are delighted to be acknowledged for our impact on the US capital markets.

Mar 22, 2023

2022 was a turbulent year for capital markets but the economic uncertainty that characterized last year is beginning to subside with signs of growing investment activity and market recovery. Companies that were hit hard by the economic shock waves of the pandemic are now adapting to the new reality and are finding ways to thrive in a changed world. With the markets on the upswing, financial brokers and dealers are eager to take advantage of new opportunities that have emerged.

Mar 16, 2023

We have witnessed several compliance challenges in the crypto space in recent months. These incidents have highlighted the importance of proper regulatory oversight and the potential risks associated with unregulated investing. Traditional investors can learn valuable lessons from these compliance issues to avoid repeating similar mistakes.

Mar 7, 2023

Investment advising has undergone significant changes recently, with the rise of self-serve investment services such as Wealthsimple and Robinhood. While these services offer a convenient and cost-effective way for investors to manage their money, they lack the personalized touch and expertise that traditional investment advisors provide. In this article, we explore the current state of investment advising, the role of traditional advisors, and the impact of self-serve platforms on Private Placements.

Feb 22, 2023

The Listed Issuer Finance Exemption only came into being in late 2022 with the intention of making capital raises easier for Canadian issuers by lowering the requirements that reporting issuers had to meet for certain raises, while at the same time opening up options for retail investors.

Feb 14, 2023

The emergence of innovative Artificial Intelligence technologies such as Open AI’s ChatGPT and Google’s Bard has made recent headlines as we begin to think about what these new developments in AI may mean for the nature of work and entire industries.

Dec 7, 2022

On September 8th 2022, the Canadian Securities Administrators announced the introduction of a new prospectus exemption called the New Listed Issuer Financing Exemption for listed issuers on Canadian stock exchanges, aimed at providing a more efficient way for them to raise capital. National Instrument 45-106 Prospectus Exemptions (NI 45-106) has been amended effective November 21, 2022 to will allow issuers to distribute freely tradeable listed equity securities to the public for capital raises up to either $5,000,000 or 10% of the issuer's market capitalization to a maximum total dollar amount of $10,000,000.

Aug 2, 2022

Our CEO Gord Breese sat down with Martin Gagel of Market Research Radius to discuss Katipult's recent customer milestones, product updates, and strategic opportunities for the company.

Jun 27, 2022

As retail participation in private placements grows, more investors are filling in complex subscription agreements that they are not familiar with. This leads to back and forth between advisors and investors correcting errors on ‘not-in-good-order’ documents. Existing manual processes are struggling to keep up, and dealers are asking themselves if there is a better way.

Mar 14, 2022

Private real estate. Hedge funds. Commodities. Cryptocurrencies. Private equity. These are just a few types of investments broadly classified under the umbrella of “alternative investments”. And it is an umbrella that is quickly growing, with total assets under management in alternatives blowing past the $9 trillion mark in 2021. Just five years ago, this figure was closer to $4 trillion.

Mar 8, 2022

In the private placements world, syndicated deals are the “big fish” everybody is aiming for. Deal sizes, commissions, and the credibility boosts are much larger. The problem? So are their complexities and inefficiencies.

Feb 2, 2022

As we move into 2022, we wanted to highlight a few of the major product updates that are being released in 1Q22 and preview what’s next in our roadmap.

Jan 17, 2022

Nineteen. That’s approximately the number of paper forms an institutional investor interested in subscribing to a private placement must fill out. From certifying beneficial ownership to confirmations that they have sufficient anti-money laundering guidelines, even getting past the first step can be a major hurdle.

Jan 10, 2022

Investment advisors today face one key challenge – creating value in ways that can resist the increasing commoditization of wealth management. Decades ago, executing simple stock market trades were expensive affairs requiring calls placed to a broker (who often also provided stock recommendations). Now, they are commoditized affairs where the main differentiator is price.

Nov 29, 2021

Are financial services companies fully harnessing the power of intelligent workflows in the private capital markets? Or are they being left behind?

Nov 16, 2021

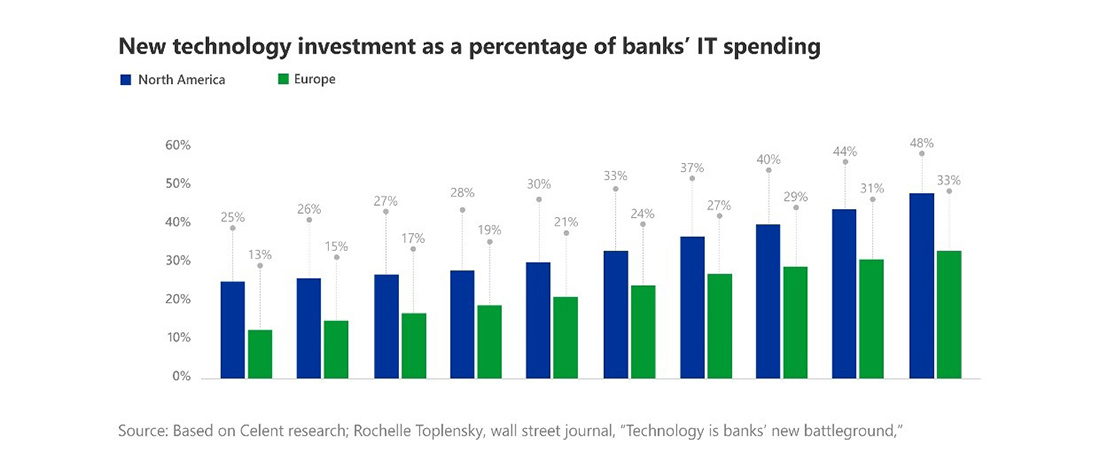

Today, financial institutions must contend with the accelerated rise of the three ‘Cs’ – competition, compliance, and costs.

Nov 2, 2021

Software is eating the world. These were the words investor Marc Andreessen – cofounder of prominent venture capital firm Andreesen Horowitz – wrote back in 2011. In the ten years since, much of his proclamation has come true. Netflix disrupted cable, Airbnb disrupted hotels, Uber disrupted taxis. And fintech is disrupting wealth management.

Oct 4, 2021

The pandemic caused widespread disruptions to global supply chains, leading to shortages and supply shocks for many goods. Although not a physical good per se, we see a similar thing happening in the private placements market.

Sep 23, 2021

Financial institutions today face a battle on two fronts. The first front is rising competition – especially from the fast-growing fintech industry which continually strives to encroach on incumbents’ territory. Nimble and digital, these upstarts are unencumbered by legacy systems and processes, giving them a powerful advantage in their quest for market share.

Jun 23, 2021

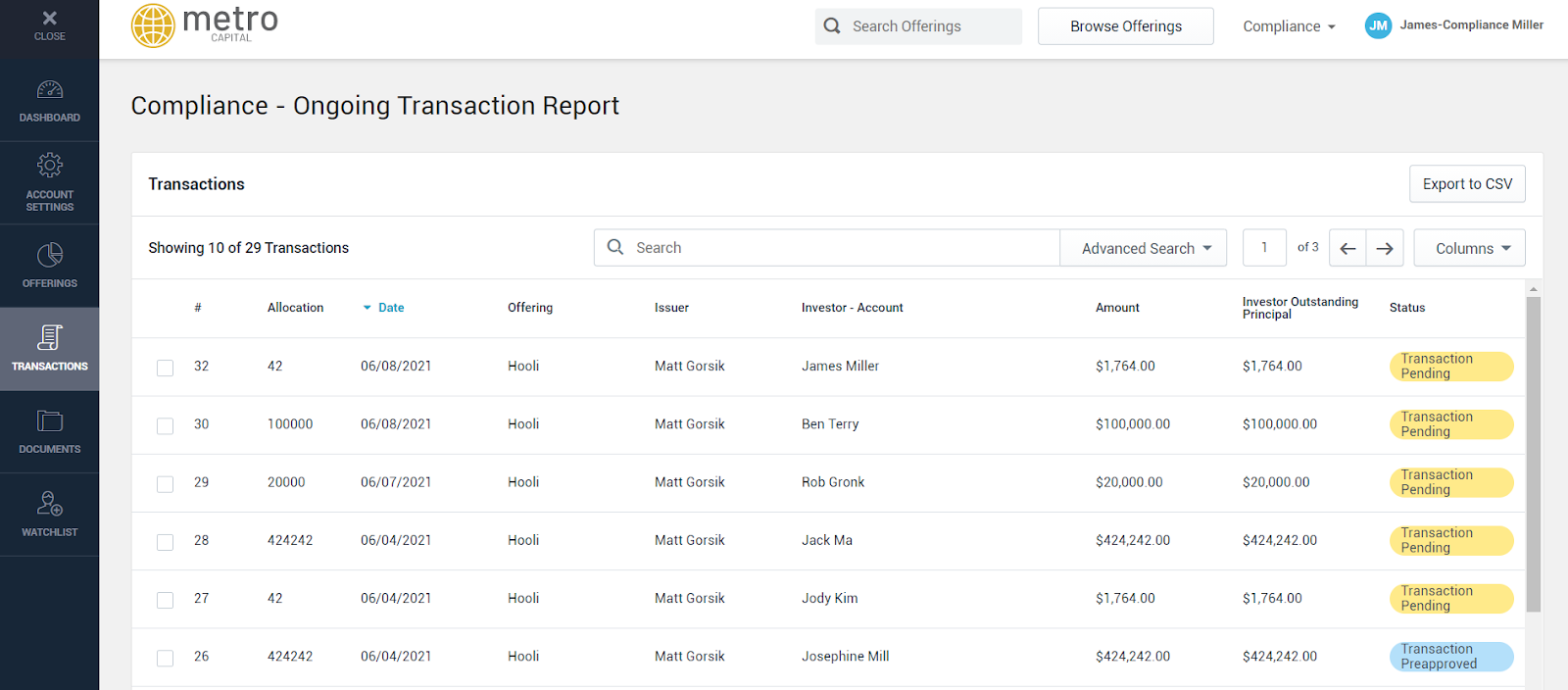

Investments in private markets are seeing traction like never before - with that, brokers are growing their top line and breaking all-time deal volume records. However, this success has created stressors for Brokerage back-office teams, especially in the compliance function.

Mar 31, 2021

The technological advancements we’ve been experiencing for the past few decades have had a profound impact on various industries. Entertainment, Retailers, Health Care, and many other industries have all adopted a tech-centered approach to their business models.

Mar 24, 2021

Canaccord Genuity to leverage Katipult's technology offering as a digital complement to its capital raising and private placement capabilities

We are pleased to announce that Katipult has entered into a multi-year software license agreement and strategic co-marketing agreement with Canaccord Genuity.

The agreements support Katipult's growth and market expansion plans with a focus on strengthening its market position in Canada and expanding its presence in the U.S., UK and Australian capital markets.

Mar 11, 2021

Katipult is pleased to announce the addition of Raymond James & Associates, Inc. to its growing customer list.

Mar 4, 2021

In February 2021 we saw Game Stop stock headlines bringing retail investors into the focus of mainstream media. Although this specific case seems to have polarized the market commentary, it undoubtedly made everyone realize how much power this group of investors can have.

Feb 16, 2021

Katipult is proud to announce that it has entered into an agreement with Canaccord Genuity, a global leader in capital markets and wealth management, for a $3.0 million corporate investment in Katipult.

Feb 8, 2021

Katipult Co-Founder Brock Murray and VP of Solution Engineering Karan Khiani joined the Fintech Fridays Podcast hosted by NCFA. They discussed a variety of topics such as going public early, evolving the product to meet complex requirements, and recognizing emerging retail investor trends.

Feb 2, 2021

Jan 29, 2021

Katipult CEO, Gord Breese, sat down for an interview with Berk Sumen, head of TSX company services for their “C-Suite at The Open” series. In an effort to highlight the “unique stories and perspectives of companies listed on Toronto Stock Exchange (TSX)”, the conversation touched on both Katipult’s business model as well as the future growth outlook.

Jan 26, 2021

A cloud-based lending platform is the heart of your online deal syndication service. It impacts every area of your business from investor servicing to loan servicing. It’s the primary way that your investors interact with your firm to access new opportunities and allocate their funds. It also scales the amount of loan administration your team can do, opening up growth possibilities for the business.

Dec 3, 2020

We are pleased to announce the addition of Mr. Karan Khiani as the Company's Vice President of Solutions Engineering and Mr. William Van Horne as the Company's Corporate Secretary.

Dec 1, 2020

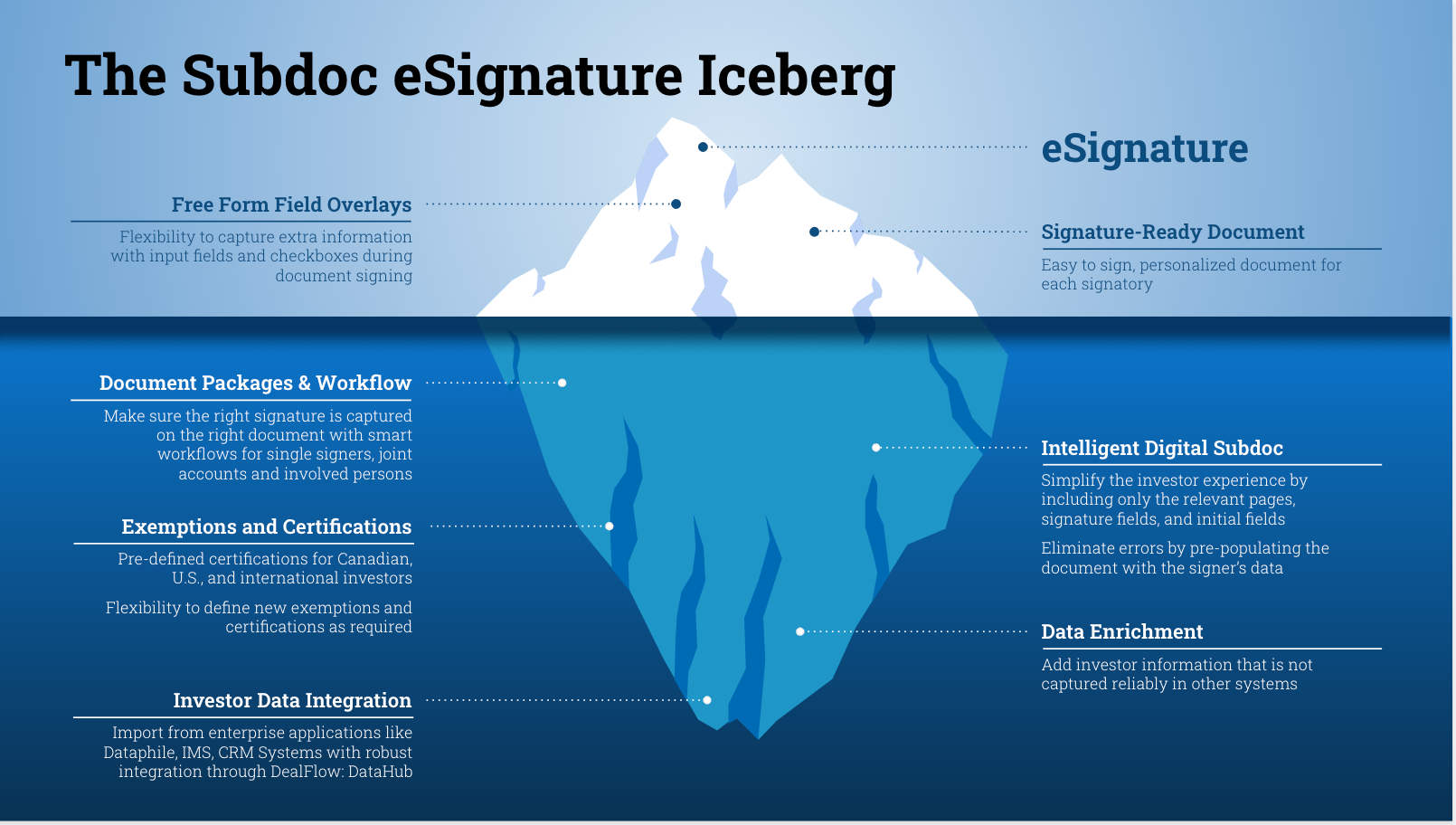

Electronic signatures have been around for some time, and even though their use can drastically streamline paperwork and save time, organizations in the investment industry have been surprisingly slow to adopt them.

Nov 12, 2020

Digital transformation is rapidly changing the way the investment industry does business and interfaces with their customers. Among the highest priorities for leading firms is the adoption of electronic or digital signatures rather than “wet” signatures. By introducing electronic signatures, the firm can move away from manual and paper-based, ad hoc processes that are plagued with deficiencies, compliance risks, and frustrations by all those involved.

Nov 5, 2020

The US Security Exchange Commission (SEC) has finally reached a decision to implement proposed amendments to the exempt offerings framework. These changes have been advocated by numerous groups over the last few years to increase activity and interest in these progressive regulations, particularly by larger and more established investment dealers.

Apr 2, 2020

As social distancing and remote working become a reality for firms in capital markets, those with strong digital operations will thrive and out-maneuver their peers in the near while developing a significant competitive advantage in the long term.

Nov 15, 2019

We are honored to be nominated by Canadian FinTech & AI Awards for the ICICI Bank FinTech Company of the Year award and we’ll be looking forward to joining the 5th Annual Canadian FinTech & AI Awards on Monday, November 18th, 2019 at the Fairmont Royal York (Concert Hall).

Nov 8, 2019

Katipult has been selected to join other leading Canadian fintech companies at the Singapore Fintech Festival (SFF) from Nov 11 - 15th 2019 in the international pavilion.

Oct 15, 2019

Katipult has been chosen to join 11 other leading high-growth FinTech companies to participate in a trade mission to the UK from October 21st - 25th 2019. From across 5 major Canadian cities, these leading companies have collectively raised over half a billion in venture capital and are well positioned for global expansion.

Sep 26, 2019

It's exciting times here at Katipult as we are pleased to announce that we started working with a prominent financial institution in Canada, ATB Financial.

Jun 26, 2019

On March 14th, 2018 Katipult published a whitepaper regarding its Investor License project that intended to address all mechanisms of investor onboarding and auditability necessary for regulatory compliance.

Jun 19, 2019

Katipult attracted industry leaders from some of the most successful tech and financial services companies to its Board of Directors. Learn why they joined the Katipult team!

Jun 10, 2019

In case you missed it, Katipult will be exhibitor booth 6 on June 12 in Toronto at the Historic Trading Floor of the Design Exchange.

Mar 1, 2019

This is the second part of our webinar covering crowdfunding law in the US. Once again we are joined by one of the leading experts in crowdfunding law in the US to present you with actionable tips on how to navigate the complex US crowdfunding regulations.

This webinar, will help you learn all about the regulations around investment crowdfunding in the US including the critical changes between different pieces of legislation such as:

Feb 28, 2019

For this webinar, we were joined by one of the leading experts in crowdfunding law in the US to present you with actionable tips on how to navigate the complex US crowdfunding regulations.

This webinar, will help you learn all about the regulations around investment crowdfunding in the US including the critical changes between different pieces of legislation such as:

Feb 21, 2019

In today’s highly competitive private capital markets, every organization is facing the pressure to automate, digitize and optimize their internal processes. The ever-expanding cross-industrial digitization generates a lot of inputs that are being processed in order to increase the quality of service these companies offer. Coupled with frequent changes in the regulatory landscape, as well as the fact that new technologies emerge almost on a daily basis, it is evident that there is pressure on capital market firms to adapt quickly, and at low costs.

Feb 19, 2019

In this webinar we provide you with actionable tips on ways crowdfunding platforms can be leveraged to efficiently raise funds and attract new investors.

In order to provide you with key insights, we'll be joined by top experts from Brickfunding, one of the leading search engines for real estate crowdfunding investment opportunities worldwide.

We will cover specific digital marketing tactics that can help your organization increase its investor base. Some of these include things such as:

Feb 18, 2019

An increasing amount of cash continues to flow into the US private placement market, which means it’s likely to attract a greater number of larger deals. Even with new issuance records being set, the investors will be asking themselves where they can find even more deals.

Feb 15, 2019

How creating your own crowdfunding platform can fast-track your company's growth

Feb 14, 2019

Most modern financial management software, regardless the industry or market segment utilize user dashboards to visually present data that is thought to be important to all system users.

Feb 13, 2019

BOLD Awards recognize top companies, projects and individuals “powering breakthroughs around the world”. The “Boldest Open Innovation” category looks at companies with bold open innovation strategy that has been effective in creating growth.

Feb 8, 2019

Katipult Technology Corp. (TSXV:FUND - Frankfurt: K10), an industry leading and award-winning fintech company, is honoured to announce its formal inauguration into the UK-Canada Chamber of Commerce.

Feb 7, 2019

Are you looking to start your own investment crowdfunding platform in Canada? For this webinar we're joined by one of the leading experts in crowdfunding law in Canada to present you with actionable tips on how to navigate the major crowdfunding regulations in Canada.

Some of the topics discussed in this webinar include:

Feb 6, 2019

In modern business, every organization is feeling some sort of pressure to automate, digitize and optimize their internal processes. This push is forcing organizations to reinvent themselves, discover more efficient ways of doing business and profoundly disrupt the industry they operate in. This pressure exists due to the simple fact that those that fail to adopt a comprehensive strategy to tackle this challenge will find themselves trailing behind competitors that are able to be more agile and cost-effective.

Feb 1, 2019

Are you interested in starting your own P2P lending platform in the UK? We sat down with Matt Williamson, Head of Fintech at Thistle Compliance and one of the leading crowdfunding and P2P lending legal experts in the UK and Sophie Long, Head of Sales at Thistle Compliance, responsible for leading customers along the FCA compliance journey to address some common questions people have on this topic. We also provide actionable tips for launching your own P2P lending platform online in the UK, navigating the legal regulations and the FCA process.

Jan 29, 2019

Your platform is the heart of your online deal syndication service, impacting every area of your business. It’s the primary way that your investors interact with your firm and research new opportunities, it impacts the amount of administration your team needs to do, and it is also a key factor in how satisfied your investors are with your service.

Simply put: the platform you choose will have a long-term impact on your brand’s reputation and success.

Despite this, many businesses choose the wrong platform for supporting the ongoing growth of their business. Many firms approach us after outgrowing other solutions – this switching cost could have been minimized by either switching earlier or choosing the right platform from the beginning.

Jan 23, 2019

For both established business as well as start-ups looking to enter the UK financial market, navigating the complex regulatory landscape can be a daunting task. To assist organizations looking to start an online finance business in the UK we've consulted some of the top experts in the space. This webinar is will provide you with actionable tips that will allow you to get a better understanding of this complex legal framework.

Nov 19, 2018

The large number of innovation labs, startups, traditional finance firms, and supportive regulators creates a truly diverse ecosystem for fintech in Singapore.

However, the regulations for starting your own online financial platform can be complex.

We joined Kim Kit Ow, from Bird & Bird ATMD, a leading legal experts to present this webinar aiming to explain the current laws and regulatory regime applicable to fintech players in Singapore.

Nov 14, 2018

The second part of the webinar that dives into the world of blockchain and securities tokenization. You can check the first part here.

Nov 9, 2018

Katipult, an industry leading fintech company, will be one of the companies exhibiting at the world’s largest fintech gathering. You can find us at booth ZH06 and at the Canada Pavilion where our CEO, Brock Murray, will be speaking on the topic of "Opportunities in Investment and Security" on November 14.

Nov 8, 2018

Katipult, an industry leading fintech company, has been selected as one of the finalists in this years Fintech Awards at the Singapore Fintech Festival by an expert panel of judges.

Oct 24, 2018

Large majority of top executives are expecting blockchain to change the way they operate. The question that everyone is asking is “How?”. This webinar aims to help you learn how to leverage Securities Tokens and Blockchain to revolutionize your business and disrupt your industry.

Oct 8, 2018

Providing investors liquidity through a secondary marketplace is a valuable capability to firms in private capital markets, especially with the rise of ICOs and tokenization of assets.

Sep 13, 2018

Katipult, an industry leading fintech company, has been shortlisted for “Best Tailored Crowdfunding Solution” by the Capital Finance International (CFI) readers and judges.

Sep 11, 2018

Crowdfunding platforms in the US are providing entrepreneurs and innovative companies with a new way of raising capital, though the number of companies that take advantage of it is still relatively small. The main reason is the legislation process and different regulations surrounding the crowdfunding platform registration.

This webinar will provide you with actionable tips on registering your crowdfunding platform in the US, and navigating Title III and FINRA.

Aug 22, 2018

[Updated in August 2018] With global transaction value set to go above US$9bn in 2018 according to Statista, the huge growth in the popularity of crowdfunding seems unlikely to end. A predicted 29% CAGR will see the industry hit US$25bn by 2022.

Aug 20, 2018

After debuting in 2017 with a nomination for Technology Innovator Award, in 2018, Katipult has been nominated in four different categories.

Aug 15, 2018

One of the biggest challenges firms are facing when raising capital with accredited investors is determining their investor status quickly, reliably, and confidentially.

Recent federal laws require companies raising money through private placement capital raises where they generally solicit to verify that their investors are “accredited investors”. A simple questionnaire isn’t enough – companies must take further “reasonable steps” to prove their investors are “accredited investors” with potentially serious consequences for failing to do so.

This is why we joined forces with Jor Law, a co-founder of VerifyInvestor.com and Principal at Homeier Law PC and one of the leading authorities on the topic of investor verification, to discuss:

Jul 25, 2018

Crowdfunding has proven to be a great way to fund businesses looking to get off the ground, and assist established investment firms to diversify their sources of capital. Not only does crowdfunding bring in new investors, but it also helps to spread brand awareness and stimulate discussions.

Capital raising has been a painstaking exercise associated with lots of regulatory hurdles and barriers. It has, therefore, become apparent that the traditional financing methods are simply not suitable for fast growing modern businesses.

Fortunately, starting a crowdfunding platform can help to overcome some of the many problems associated with traditional capital raises and investor management.

If you are still unsure of what crowdfunding type is right for your business, you can check our article discussing different types of crowdfunding.

Here we will discuss some of the benefits of starting your own crowdfunding platform and why this solution may be right for your business.

Jul 3, 2018

Crowdfunding has been a topic of interest for quite some time now as it has allowed thousands of small businesses and individuals to gather the capital they need to fund their growth, idea or product/service development. That being said, the landscape of crowdfunding is quickly changing. New crowdfunding platforms are entering the market to fulfil the demands of various niche and industry-specific groups.

With ample opportunity to create the next great crowdfunding software, there remains one question: how do you get in the game now before it’s too late? And what are the steps to build, scale and start your own crowdfunding platform?

Jun 21, 2018

We are pleased to announce we’ve achieved a major milestone (while adhering to our previously announced timeline of 2Q18) to introduce a blockchain-based secondary market product, which includes capabilities such as issuer buybacks, bulletin boards and auction-based price discovery. Katipult customers will be able to offer tradable securities, introduce smart contracts, and automate clearing and settlement for transactions at a much faster rate, while ensuring both the security of payments and regulatory requirements.

Jun 7, 2018

Crowdfunding, or crowdinvesting, is an effective alternative method for connecting investors with opportunities to invest in specific products, campaigns, and even entire businesses. By creating your own investment management platform, you can: disrupt and reshape your industry, provide a highly valuable service, and help turn business ideas, dream projects, and new products into reality.

However, before you can start your own crowdfunding platform, you need to decide which type of crowdfunding is appropriate for your industry. Your decision will depend upon the business models and personal preferences of the industry you serve, as well as the capabilities of your investment crowdfunding software.

May 28, 2018

SWIFT Business Forum Canada gathered over 340 financial service leaders to discuss the opportunities and threats of rapid technological advancement across the financial ecosystem in Canada.

Our CIO, Ben Cadieux, was one of the panelists for “Shaping the Future: Innovation in Action” together with Tim Hogarth, VP of Innovation Strategies and Framework at TD Bank Group, and Nicholas Bayley, Managing Director of Accenture Strategy at Accenture Canada. The panel was moderated by Ryan Masters, Executive Director & Strategic Relationship Manager at SWIFT.

The panel was aiming to uncover how leaders are shaping the future of financial services by strategically employing new technologies, successfully utilizing information and Big Data, and reshaping their infrastructures.

Here are the 5 key takeaways from the panel “Shaping the Future: Innovation in Action” on SWIFT Business Forum Canada 2018:

May 10, 2018

Katipult took part in the inaugural Tokenomx crypto conference in Chiang Mai, Thailand at the Le Meridien Hotel on April 18-19, 2018. Katipult also co-hosted a Speaker Dinner event with its Thailand-based customer iLab, at the highly acclaimed David’s Kitchen for all VIP ticket holders, speakers, and sponsors from Tokenomx. Over 100 people showed up for the event.

Apr 30, 2018

As our firm continues to explore the global opportunities in major financial centers, we are excited to have recently added two regulated firms from the United Arab Emirates (UAE), including a subsidiary of a publicly listed entity on the Abu Dhabi Securities Exchange. This milestone starts our coverage of the UAE and cooperation to adhere to the regulatory requirements in the country.

Apr 26, 2018

The GDPR (General Data Protection Regulation) is a new regulation for organizations dealing with data from EU citizens. In this article, we’ll discuss how the GDPR affects Katipult platforms and the necessary steps to make the platforms GDPR compliant.

Apr 20, 2018

In today’s interview with our Board Members, we talked to David Jaques, the first CFO for PayPal. David serves as Chair of Compensation and Governance Committee and Member of Audit Committee for Katipult.

In his early career, Mr. Jaques held various positions with Barclays Bank in London and provided advisory services in currency and interest rate risk management to the bank’s corporate clients. He held a similar role at Barclays Bank, New York from 1988 to 1993. One of his most notable positions was as the first CFO for PayPal from 1999 to 2001 where he established PayPal’s financial planning and accounting processes.

Apr 18, 2018

Know Your Customer (KYC) is a standard due diligence process used by investment firms i.e., wealth management, broker dealers, private lenders, commercial real estate investment, among others to assess investors they are conducting business with. Apart from being a legal and regulatory requirement, KYC is a good business practice as well to better understand investment objectives and suitability, and reduce risk from suspicious activities.

Mar 20, 2018

Katipult is pleased to announce its panel participation in the SWIFT Business Forum Canada on March 21st, 2018 in Toronto Canada, joining industry heavyweights TD Bank and Accenture, to discuss the future of financial services and the transformation of their infrastructure.

Mar 19, 2018

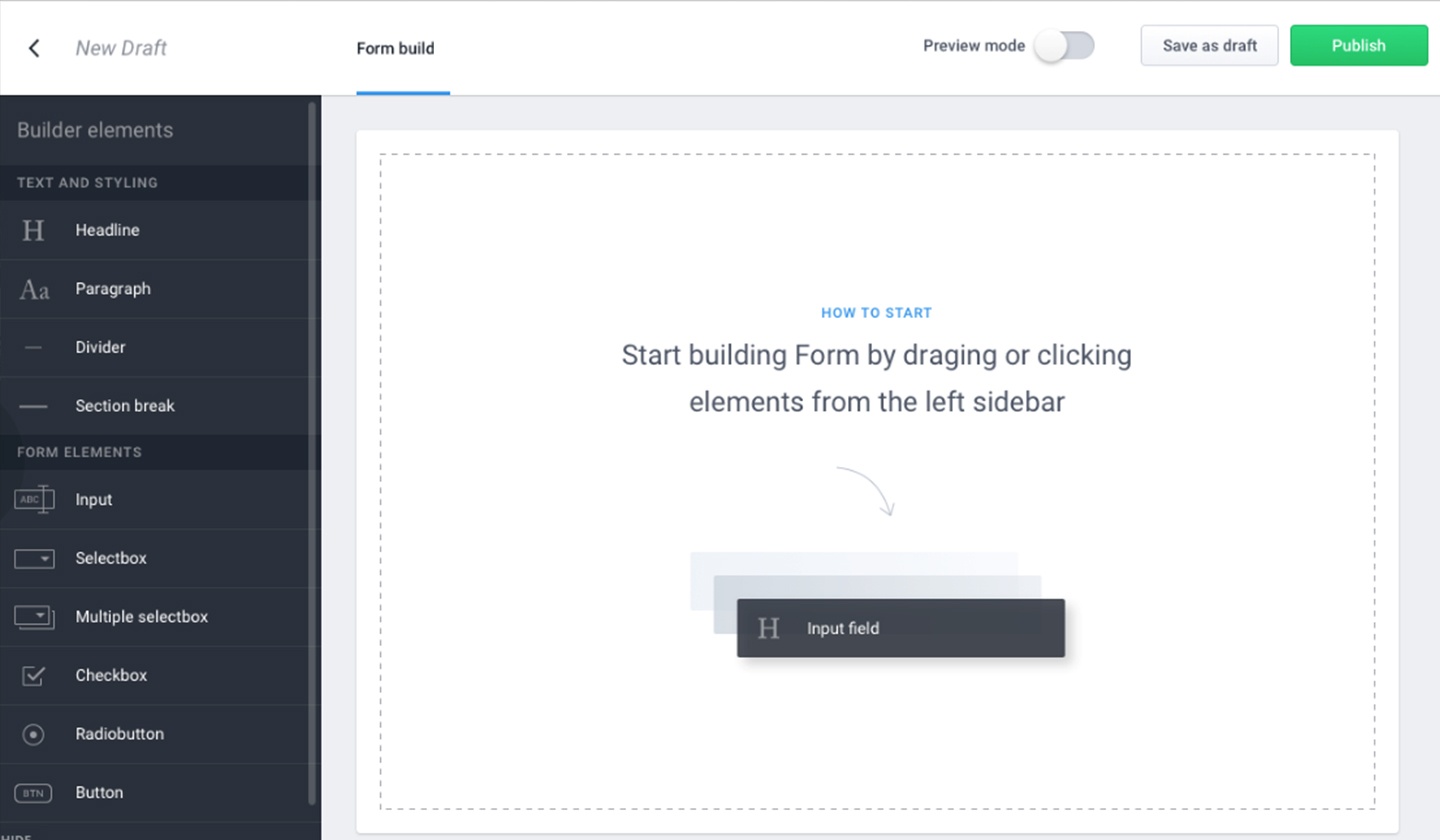

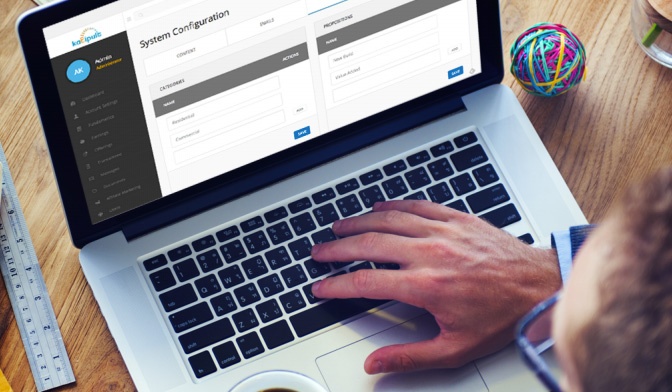

Katipult announces addition of proprietary Dynamic Form Builder module to enable rapid implementation of highly sophisticated user and investment onboarding forms. No coding needed! Build custom investor and issuer onboarding forms as well as custom project and loan applications. As easy as your favorite form building products Google Forms and Wufoo.

There is already a number of customers that are part of the pilot project and that have started using the new Dynamic Form Builder feature within their platforms, including MaRS VX. You can learn more how MaRS VX is integrating the Form Builder with their SVX platform in our press release.

Here are some of the most important features of the Dynamic Form Builder:

Mar 16, 2018

We've partnered with Jor Law, a co-founder of VerifyInvestor to present a webinar on how to find accredited investors and best practices of verifying them.

Mar 6, 2018

Crowdfunding Portals continue to disrupt traditional ways of raising capital by leveraging the historic reforms under the JumpStart Our Business Startups (JOBS) Act, financial technology and growing demand by self-directed and nonaccredited investors who seek to invest in potentially innovative ventures.

With 38 funding portals registered with the Securities and Exchange Commission (SEC) and members of the Financial Industry Regulatory Authority (FINRA) raising over $100 million of capital since adoption, crowdfunding is providing private companies much needed access to capital and investors new investment opportunities. Crowdfunding Portal registration has expanded beyond just US based portal operators with two non-resident portals registering with the SEC from Hong Kong and Canada.

Feb 13, 2018

We spoke with Mr. Marcus Shapiro, the Chairman of the Board of Katipult, to find out what attracted him to Katipult, what are his impressions so far and what he expects from Katipult in the future.

Before joining the Katipult’s team, Mr. Shapiro worked at HSBC Investment Bank and its predecessor firms in London and New York, as an advisor on capital markets issues, corporate strategy and M&A. Apart from his 25-year career in investment banking, Mr. Shapiro has a background in practising corporate law in one of London's leading commercial law firms.

Feb 8, 2018

“Blockchain Will Do to the Financial System What the Internet Did to Media” - Harvard Business Review (March 2017).

The industry changed dramatically at the end of 2017. Crypto and ICO’s exploded, billions of dollars were raised without proper compliance, and regulatory authorities are now trying to catch-up. As a software infrastructure company it’s our responsibility to drive innovation for our customers and ensure they have the technology for a sustainable advantage over their competitors.

In the Spring of 2017 we announced the introduction of blockchain technology within the Katipult infrastructure with a goal of providing our customers with cutting-edge technology and capabilities which further improves efficiency and reduces costs by eliminating third party intermediaries.

Jan 29, 2018

"I think that Katipult’s value proposition is really attractive to investment managers. With the pragmatic application of blockchain, I think that’s going to make it a very useful tool for investment managers." - Jeff Dawson

Jan 25, 2018

We’re excited to be a part of Canada’s largest technology investment conference, Cantech, in just a few days!

It all happens at the Metro Toronto Convention Center in Toronto on January 31st—when this incredible conference brings together over 3500 of Canada’s top investors and more than 100 leading technology companies.

Jan 23, 2018

In August 2017, Katipult appointed Paul Sun to its board of directors. Sun brings over two decades of investment banking experience to the role, having held senior roles at Scotia Capital, Desjardins, and Beacon Securities. In addition to being a member of Katipult’s board, he is the acting CFO of Draganfly Innovations Inc. and sits on the board of Global Gardens Group (TSXV:VGM).

We sat down with Sun to learn more about why he joined Katipult’s board, his impact on the firm, and what he sees for Katipult’s future.

Jan 22, 2018

One of the issues with private markets is that liquidity can be difficult. For investors , there are situations when they have taken equity or debt positions in a company or investment product but have been unable to withdraw their investment.

Life brings challenges, and sometimes a shareholder is better off with cash than with shares. If the company is not in a position to buy those shares back, the investor may want to trade them with another investor.

This seems like a simple idea, but in practice there are some challenges. Without computational trust, a third party needs to facilitate the transaction. This brings in fees, extended processes, and, in general, complication.

At Katipult, we imagine a world where this is a straightforward process with as little interference between the two parties as possible. And we believe that BlockChain technology and its inherent computational trust make this a real possibility.

Jan 19, 2018

The internet is always evolving, and BlockChain is a great example that our ways of thinking about the internet are changing.

At Katipult, we believe that the main benefit BlockChain brings to the digital ecosystem is the idea of ‘computational trust’. This is a brand new concept to the human brain, and it’s going to take us quite a long time before we truly understand all the implications behind this idea.

In this article, we’ll do our best to explain what computational trust means, and how BlockChain makes it possible.

Jan 16, 2018

We’ll be opening the Toronto Stock Exchange on January 17th!

Dec 18, 2017

With more than 30,000 attendees from over 100 different countries, the highly anticipated Singapore Fintech Festival was once again a great success! Financial leaders and Fintech firms from across the globe have come together to discuss cutting-edge topics including blockchain and ICOs. Among other topics, one of the burning discussions was how fintech was becoming more mainstream in the financial sector.

Nov 29, 2017

Katipult was one of eight companies selected to exhibit at FIT Tokyo 2017, an annual event organized by The Japan Financial News in Tokyo’s financial district since the year 2000. Over 15,000 attendees from Japan's finance sector will be present to identify FinTech products gaining traction in other key financial hubs.

Nov 22, 2017

If you’re relying on Excel, Google Sheets, or other generic spreadsheet software for your private equity firm, you’re only hurting your business.

Nov 22, 2017

How much of your private equity firm relies on Excel, Google Sheets, or similar spreadsheet software?

Nov 21, 2017

Katipult is now available for purchase on the Toronto Venture Exchange under the ticker symbol (TSXV: FUND). As indicated in our filing, we have already raised funds for our 12-month growth plans.

Nov 15, 2017

Following a strong year of growth in 2017, Katipult has been nominated for the FinTech Startup of the Year Award at the 3rd Annual Canadian FinTech & Artificial Intelligence Awards.

Nov 9, 2017

Attracting investors is one of the most important tasks you face as a growing firm.

Oct 10, 2017

The TSX Venture Exchange serves as a public venture capital marketplace for emerging companies, particularly in Canada's natural resource and technology sectors.

Jul 12, 2017

Brock Murray (CEO) and Pheak Meas (COO) of Katipult, a SaaS company that enables firms to design, setup, and manage an investment crowdfunding, Peer to Peer lending, or investor management platform, has been named a finalist in Ernst & Young’s Entrepreneur of the Year in the Emerging Technology category in Prairies. Brock and Pheak founded Katipult in May 2014 and have since grown the company in over 20 countries with staff across four continents.

Jul 6, 2017

Money 20/20 came to Copenhagen, Denmark June 26th-28th and attracted over 6,000 attendees which places it among Europe's largest Fintech events. The momentum signals a growing regional interest in investment crowdfunding, peer to peer lending, investor management, robo advisors, cross border money flows, cryptocurrency and blockchain.

May 2, 2017

Katipult is honored to add the FinTech Breakthrough Award to the growing list of distinctions that it has received this year. With over 3,000 nominations for the FinTech Breakthrough Awards the competition was extremely tough, particularly in the lending categories. The awards are determined by a panel of impartial senior-level judges, which included analysts, journalists, and technology executives who have worked in the industry.

Mar 29, 2017

What?

As Katipult’s CTO, I’m frequently being asked by our customers if and what we’re going to do with BlockChain. The idea of BlockChain is absolutely viral in the FinTech sector right now, and it seems that every company is eventually going to need some perspective on it. To me, it no longer seems like an avant garde idea. It now seems that the benefits will cause the technology to propel forward exponentially - but how?

Mar 3, 2017

On January 15th, 2017, the Canadian Consulate of Hong Kong brought the top 6 Canadian Fintech companies from Canada to Hong Kong to learn about the local markets, develop key business contacts, meet with institutions and regulatory bodies, and tour HK’s newest Fintech centers. It was a great experience full of networking, pitching, partnerships, and how our Katipult solution can be applied to this dynamic market.

Feb 22, 2017

Site: https://www.fundingnomad.com

Location: Canada, United States & Cayman Islands

Contact: Brad Kerr (brad@fundingnomad.com)

Sector: Entertainment & Media

Feb 8, 2017

Calgary, February 7th, 2017. Canada’s Fintech standout Katipult has secured a substantial capital investment in a round of funding according to CEO and Founder Brock Murray. The company provides a Platform-as-a-Service that’s like Shopify for private capital markets. Its software allows firms to setup and manage a platform to offer privately issued, exempt securities to non-accredited, accredited and institutional investors.

Jan 27, 2017

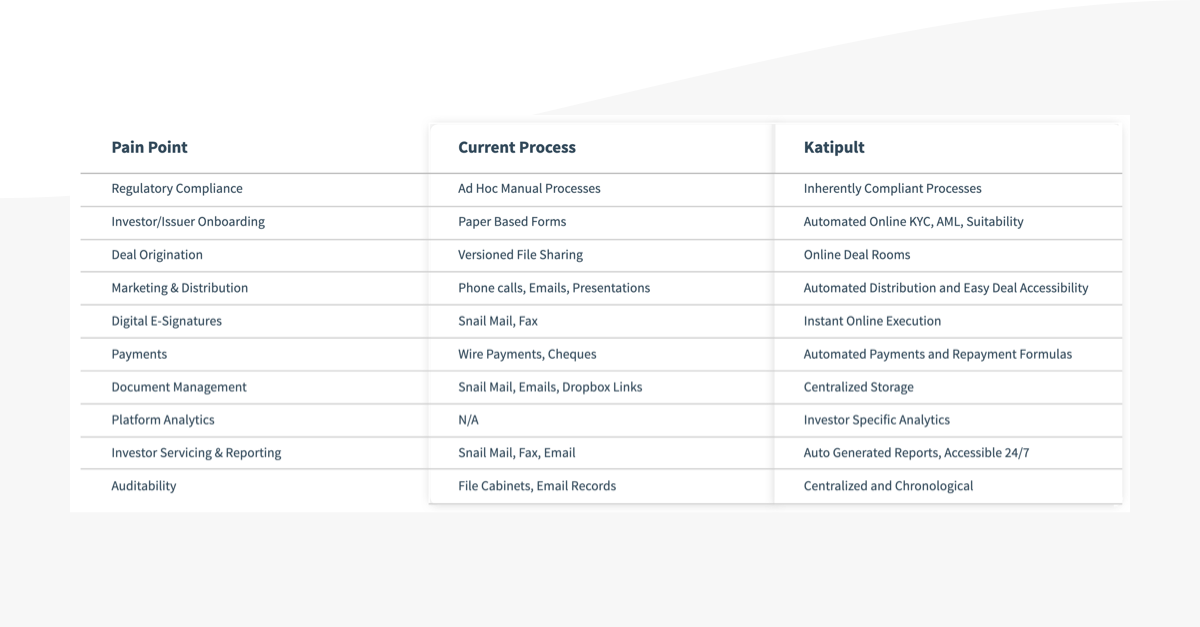

Private capital markets are plagued with compliance requirements and operational inefficiencies, and software can eliminate many of the pain points from deal administration to investor reporting. For this reason traditional finance firms are looking at investment crowdfunding, peer to peer lending, and investor management solutions to stay relevant within this industry among the upstart Fintech (FInancial Technology) players.

Jan 11, 2017

After completing a highly competitive application process, Katipult and five other Canadian fintech companies are selected to participate in the Canadian Fintech Mission to Hong Kong! The mission was announced following the venture capital-backed investment in Canadian fintech companies hit its highest level in almost two decades.

Nov 1, 2016

Discussion of cross-border technology concerns is agreed upon by both jurisdictions.

Oct 27, 2016

Canada’s technology sector can proudly speak of a number of homegrown giants disrupting online sectors from social media management (Hootsuite), to web browsing (Mozilla Firefox), ecommerce (Shopify), and also workplace chat (Slack). Katipult is looking to be placed amongst these names as the dominant Canadian player in Financial Technology (Fintech).

Oct 18, 2016

London, October 19th, 2016. Katipult is pleased to announce its partnership with MANGOPAY to bring a disruptive lending solution to the UK market. As lending platforms are flourishing, the need to have a secure and flexible transaction environment to manage the incoming and outgoing payment flows is crucial. That’s why Katipult created a powerful P2P lending software which facilitates the entire investment process from marketing and distribution through to investor tax reporting.

Oct 5, 2016

The abolition of a law that prevented banks from owning more than 5% of technology companies in Japan is set to open the investment floodgates into financial technology (fintech).

Sep 12, 2016

A major announcement was unveiled at The Treasury Markets Summit 2016, jointly organized by the Hong Kong Monetary Authority (HKMA) and the Treasury Markets Association (TMA) on September 6th, 2016. Two initiatives including a Fintech Innovation Hub and Fintech Supervisory Sandbox, effective immediately, will be launched for financial technology innovation in the banking sector to ensure the city doesn’t lose ground to regional rivals including Singapore and Tokyo.

Jul 27, 2016

WeAreStarting www.wearestarting.it (also accessible at www.wearestarting.com)

Jul 5, 2016

The Monetary Authority of Singapore (MAS) makes its move after public consultations to provide industry direction and safeguards for retail investors.

Jun 29, 2016

Katipult is cloud-based software infrastructure that allows firms to design, setup, and manage an investment crowdfunding platform. As a crowdfunding software provider we talk to private equity, asset management, banks, and entrepreneurs on a daily basis who are looking for investment crowdfunding, private placements, and investor management solutions.

Jun 15, 2016

From June 15th-17th Calgary based Katipult will attempt to put Western Canada on the map as a Fintech leader, and highlight the digital trends in private capital markets within Canada. Leaders in financial technology (fintech) from across Canada will be at the Westin Calgary & Metropolitan Conference Center for the largest payments conference. More than 90 speakers are set to take the stage to discuss payments disruption, policy, innovation and opportunity.

Jun 14, 2016

The UK crowdfunding rules are governed by the FCA (Financial Conduct Authority). However the UK Crowdfunding Association (UKCFA) has come up with a code of practice that is worth noting.

May 20, 2016

The world’s biggest banks and technology firms are set to converge on Madrid, Spain June 21-22 for MoneyConf, and Katipult will be among the exclusive group of companies selected to exhibit at the prestigious Fintech event that helped elevate companies like Stripe in previous years.

Apr 20, 2016

Maritime Properties is a licensed real estate brokerage that has been committed to helping it's customers buy, sell and invest in real estate for for almost 2 decades.

Apr 12, 2016

Toronto, ON – March 31, 2016 – VersaPay Corporation (TSXV: VPY) ("VersaPay" or the "Company"), a leading provider of cloud-based payment and accounts receivable management solutions, today announced that it has signed a partnership agreement with Katipult Software to bring a disruptive Crowdfunding solution for investment firms in the Canadian market. VersaPay’s gateway technology enables Katipult to provide customers using its crowdfunding software product with an integrated secure payment capability.

Apr 5, 2016

• The Canadian company Katipult launches its white-labelled crowdfunding software in the UK.

Mar 14, 2016

While the regulatory frameworks and rules for investment crowdfunding with accredited investors and non-accredited investors vary from country to country, there are four key considerations for bringing an online investment platform to market.

Depending on the platform structure and area of operation, the themes below highlight the considerations when dealing with security commissions and regulatory authorities.

General Partner vs. Intermediary models

The real estate marketplace model is what we define as the intermediary model, where the platform owner and the companies raising capital are independent. While the platform may screen issuers and deals for quality, the deals are still managed by third party issuers. The business model is usually transaction success fee driven, which in most countries requires some type of financial license. The other option is the General Partner model where the platform is being used to market proprietary deals online, using a management fee + % of profits business model. The General Partner model is the easiest as a starting point in most regions as firms are typically shifting their offline activities online and leveraging the same compliant processes.

Solicitation vs. Non-Solicitation

The solicitation ability will be a game changer in the long term, particularly with Title III rules in May 16th 2016, which include non-accredited investors. It is great to see frameworks in place for accredited investor solicitation in a number of influential countries as a starting point. Many groups will be more comfortable in the short term launching a non-solicitation platform. This is because it’s in line with their current investor onboarding methods without “generally” soliciting, such as scheduling web conferences/phone calls/face-to-face meetings with new investors that have been referred, introduced, etc. Under this scenario, the investment platform is acting as an investor relations tool for efficiencies and a better investor experience. General solicitation can always be used at a later date for permitted marketing strategies.

Debt vs. Equity

Debt based platforms often sidestep stricter securities laws regarding equity. Starting with debt deals rather than equity, and evolving the platform for equity deals in the future is a possibility. Understanding the differences in compliance related to the two instruments may create a feasible roadmap for the business.

Domestic vs. Foreign Investors

Regulatory bodies in most countries are focused on protecting domestic investors than foreign investors. Whether your focus is high net worth individuals or institutional firms, dealing with foreign investors may open up additional possibilities or liabilities. Thus, it is important to grasp the implications of both focus to navigate the best go to market strategy.

Under every scenario, enlist the services of an experienced securities lawyer in your region to create a go-to-market strategy for your platform that is fully compliant.

Article also appeared on timesrealtynews.com:

http://timesrealtynews.com/top-4-considerations-for-launching-an-online-investment-platform-for-real-estate/

Mar 2, 2016

The Title III provisions were described by Forbes Magazine as the democratization of investing. Mark Roderick, a leading Crowdfunding attorney wrote, 'Title III Crowdfunding is like nothing seen before in the U.S. securities industry.' Through Crowdfunding non- accredited investors (making under $200,000 in income and less than $1 million in net worth excluding their primary residence) can invest in anything from a start up company to real estate. Investments that in the past have been available primarily to the accredited investor (making over $200,000 in income with more than $1 million in assets net primary residence).

Mar 2, 2016

We have all heard the term caveat emptor, Latin for let the buyer beware. All securities offerings come with lengthy legal jargon essentially informing the investor that past returns are no guarantee of future earnings. These rules, however, do not protect the investor from potential fraud. The first prosecution of a fraud case involving crowdfunding was filed by the SEC in the US District Court of Nevada. The company in question had used several crowdfunding platforms to raise money under the Title II rules of the JOBS Act. The complaint alleges that only a small percentage of the money raised went into the stated investment and was instead funnelled into 'expenses'. So what is a potential investor to do? The answer is due diligence and investing in platforms backed by real property.

Jul 30, 2015

On a global stage, Crowdfunding is democratizing financial markets and shifting an entire industry online.

Jul 30, 2015

Until not so long ago, commercial real estate investment in the U.S. belonged to the limited class of accredited investors. Institutions and wealthy families were the only groups authorized to preserve wealth or speculate with real estate. Now, with the explosion of online crowdfunding and the slow but relentless legal opening of the market to smaller investors by the SEC, every person can join the wealthy and participate in what’s expected to become one, if not the biggest, of financial investment opportunities.

A real estate crowdfunding online platform matches investors with sponsors of real estate projects, whether single family homes, apartments, retail, hotels, office buildings, or else. It operates under two different models: the debt crowdfunding, which lends money to a company to buy the property and the equity crowdfunding, purchasing shares in the company that buys the property.

Benefits may come then from returns based on a traditional model of debt and interest, or from equity.

900-903 8th Ave SW

Calgary, AB T2P 0P7