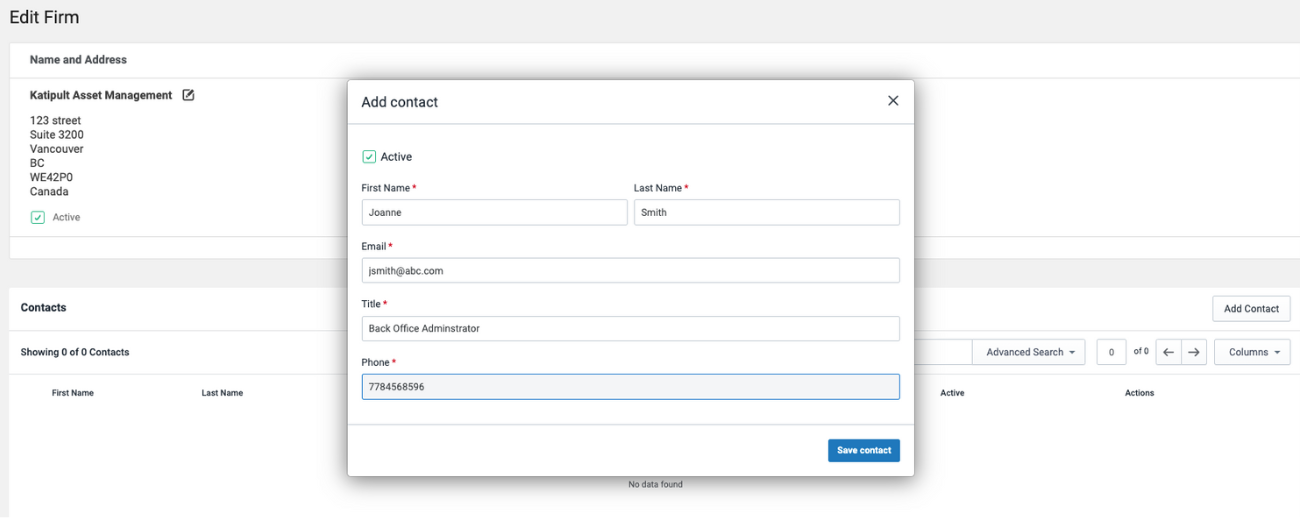

Achieve true collaboration between institutional sales and ECM desks by providing a single platform for all parties to access deal information, eliminating issues around multiple copies of spreadsheets and security vulnerabilities.

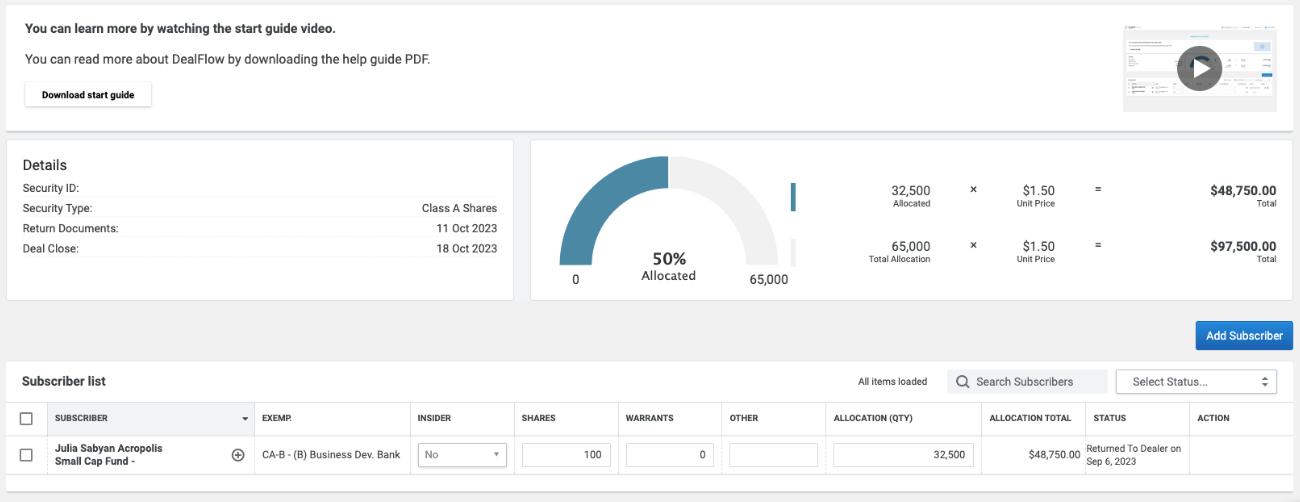

Book a DemoDashboards provide ECM teams real-time visibility into individual institutional investors’ progress through the deal workflow. Icons and flags illustrate the status of each participant, removing the need to chase people by phone or email.

Book a Demo.png)

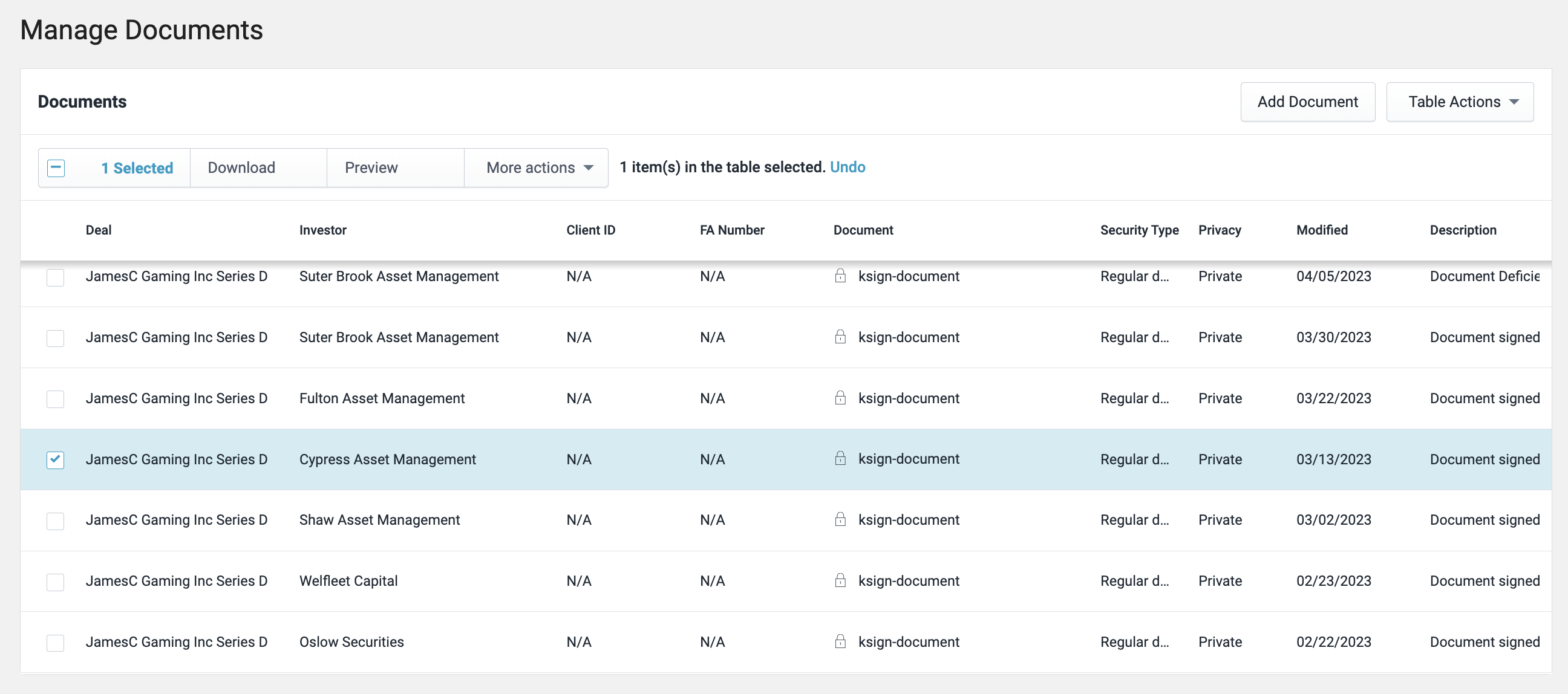

Accessing documents through DealFlow’s secure document vault rather than email attachments, network drives, or hard drives enables firms to maintain documents in an orderly fashion, making it easier to audit for compliance reviews.

Book a DemoBy using a central data center rather than multiple spreadsheets, ECM teams can quickly and easily access data to report on the performance of deals and activities of investors. These insights can help executives to identify upcoming trends faster and be more responsive to clients.

Book a Demo.png)

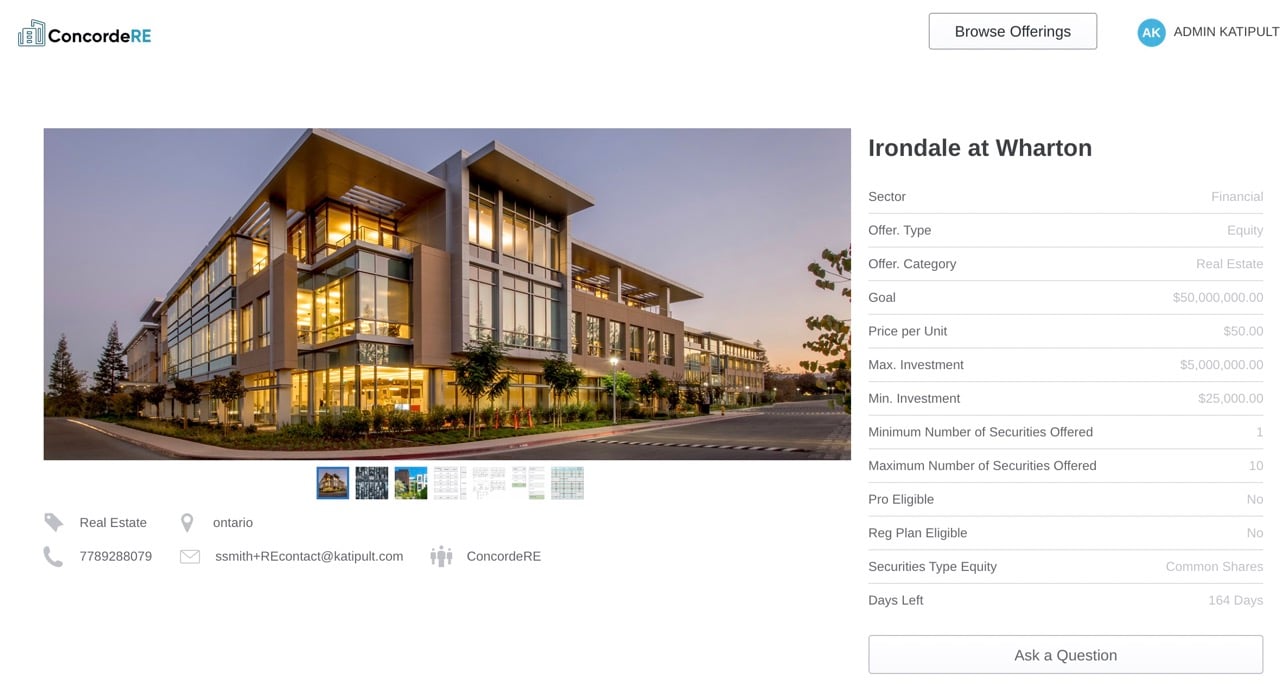

Elevate the investor experience by reducing the effort to complete subscription agreements and enabling investors to access a repository of completed deals.

Book a DemoBy providing a suite of cutting-edge tools to Institutional Sales teams, firms increase their ability to attract and retain talent and the books of business they can bring into a firm.

Book a Demo

.png)

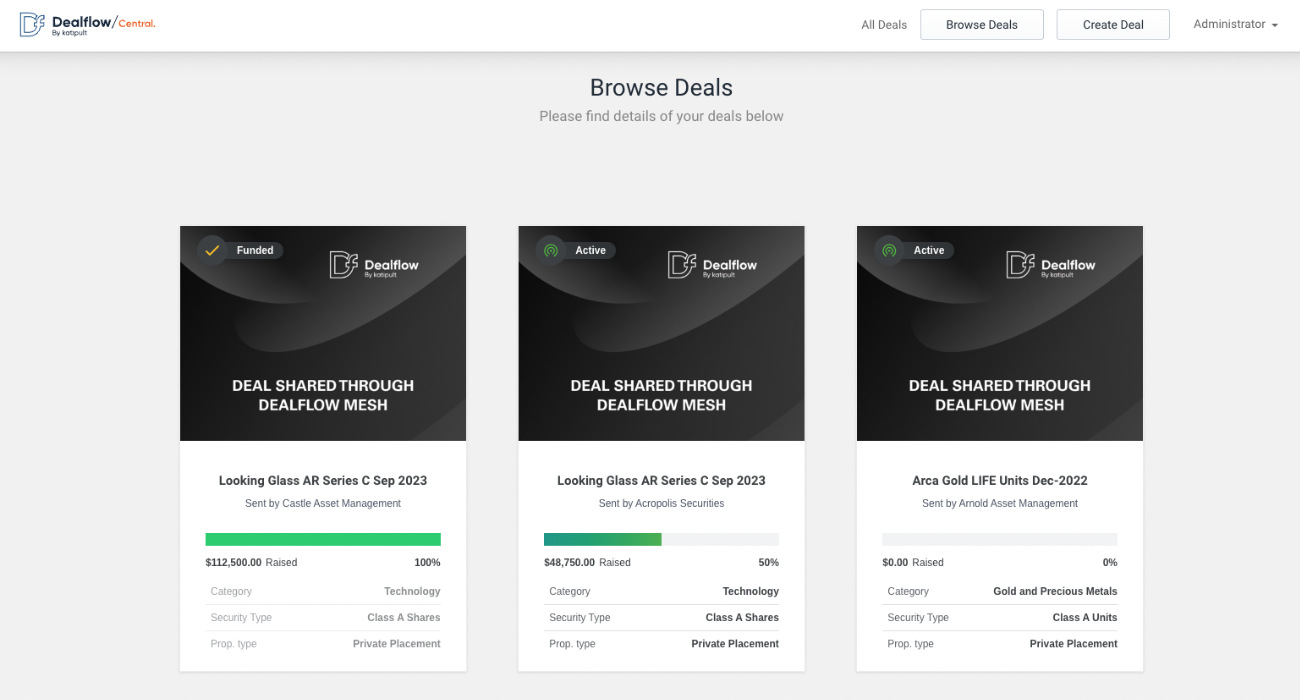

DealFlow Central is Katipult’s proprietary technology enabling connectivity between investment dealers, institutions and subscribers. When a dealer launches a new institutional deal, institutional participants can maintain subscriber details, sub-allocate their fill, and process subscription agreements electronically.

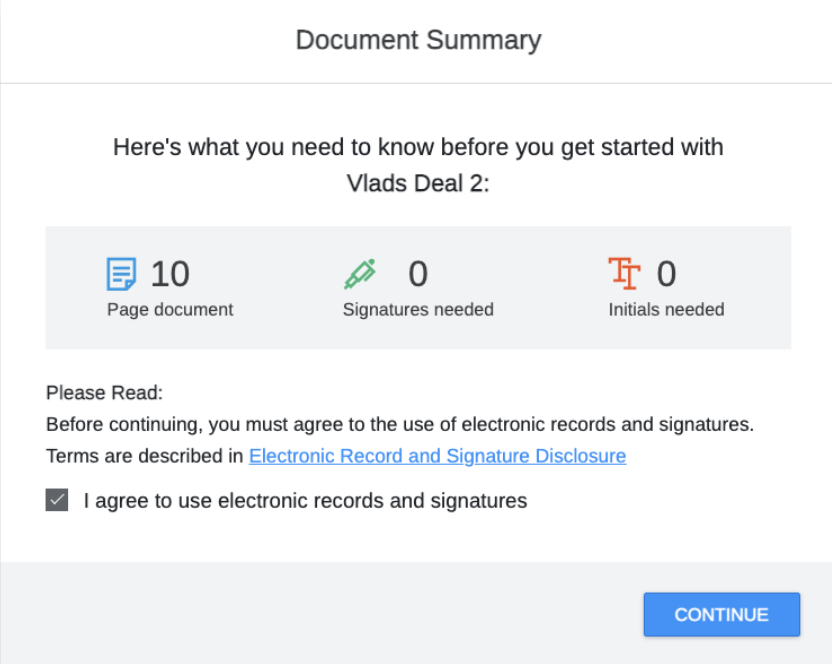

Book a DemoThe subscription agreements are auto-populated with subscribers’ key details, leaving minimal data entry for them and providing an easy-to-use e-signature experience.

Book a Demo

DealFlow Central also paves the way for DealFlow Mesh, which will power collaboration across investment dealers by delivering a cohesive and transparent network between equity capital markets teams, wealth management divisions, law firms and issuers.

Book a DemoDownload the DealFlow Institutional product guide now to understand more about key benefits, features and functionality.

Read more about DealFlow Mesh, which will enable financing syndication automation across multiple investment dealers.

Katipult DealFlow is changing the way that capital is raised with efficient and streamlined workflows which enable deals to close in days, not weeks or months.

Get answers to your unique questions, see the investment platform in action and discover why Katipult DealFlow is the right capital markets technology for your business.

900-903 8th Ave SW

Calgary, AB T2P 0P7