Katipult DealFlow offers configurable hedge fund management tools to power fundraising, performance reporting and investor engagement.

Elevate your hedge fund's operational prowess with Katipult DealFlow. The platform gives fund managers data and insights to market and launch new funds and ensures that investor communication happens efficiently and effectively.

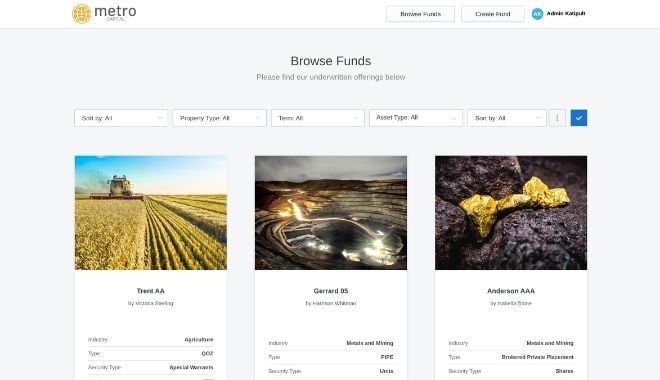

Katipult DealFlow provides Hedge Funds with tools to engage with new and existing investors when marketing and launching new funds, while real-time reporting enables fund managers to track and manage fund participation progress.

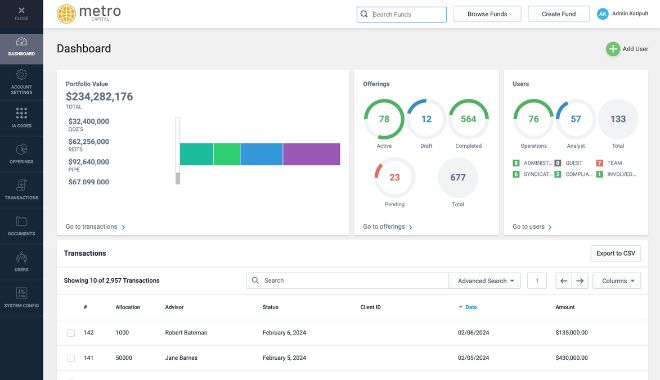

Guided smart forms reduce document errors, making it easy to onboard new investors through DealFlow Accounts. Configurable dashboards provide visibility into pipeline performance, enabling managers to close deals with investors and LPs.

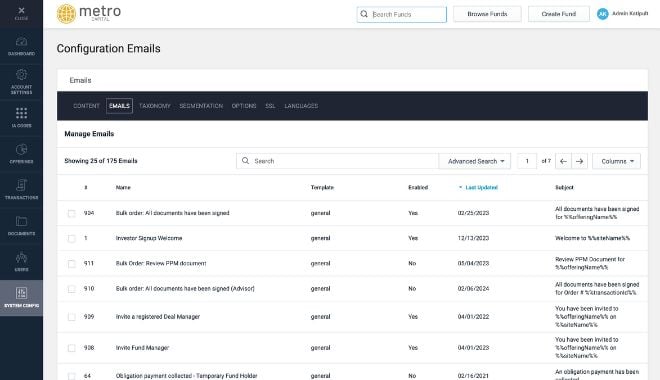

Efficiency is the heartbeat of successful hedge fund operations, and our platform provides the rhythm. In addition to automating routine tasks, Katipult DealFlow drives operational excellence by standardizing workflows to reduce errors, ensure compliance, and accelerate document distribution.

Automation doesn't just save time; it elevates the entire operational landscape, reducing the margin for error and allowing hedge fund managers to focus on adding value and delivering returns.

The demand for rich and detailed insights in the hedge fund industry is non-negotiable. Katipult DealFlow enables hedge fund managers to gain performance insights and customizable reports and dashboards.

Learn More

Enables the PPM distribution and allocation management for large institutional investors in private deals.

Enhanced investor CRM to distribute and track detailed deal information to individual and institutional investors securely.

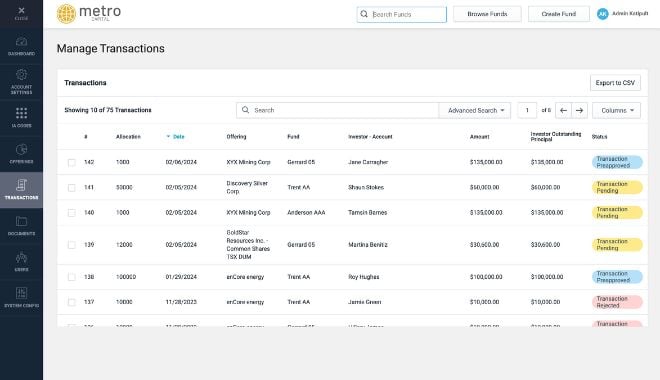

The workflow engine to manage investor participation in private placements, Reg D or Reg S offerings, or Funds.

Katipult DealFlow is changing the way that capital is raised with efficient and streamlined workflows which enable deals to close in days, not weeks or months.

Get answers to your unique questions, see the investment platform in action and discover why Katipult DealFlow is the right capital markets technology for your business.

900-903 8th Ave SW

Calgary, AB T2P 0P7