DealFlow Core delivers seamless, intelligent workflows that are automated to reduce time and effort, delight investors and close deals faster. This enables ECM teams to fill more deals without increasing headcount, driving improved profitably for investment firms.

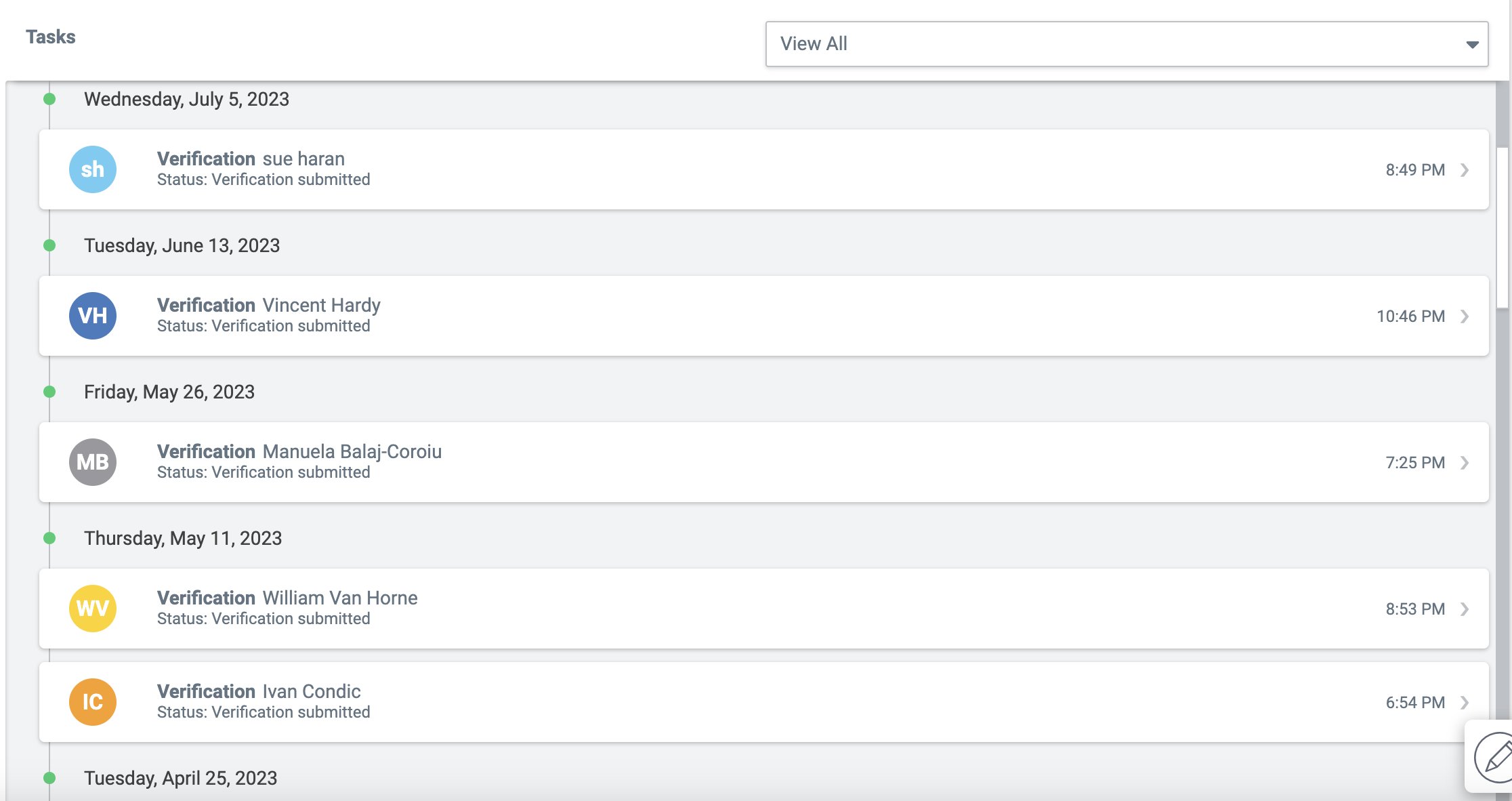

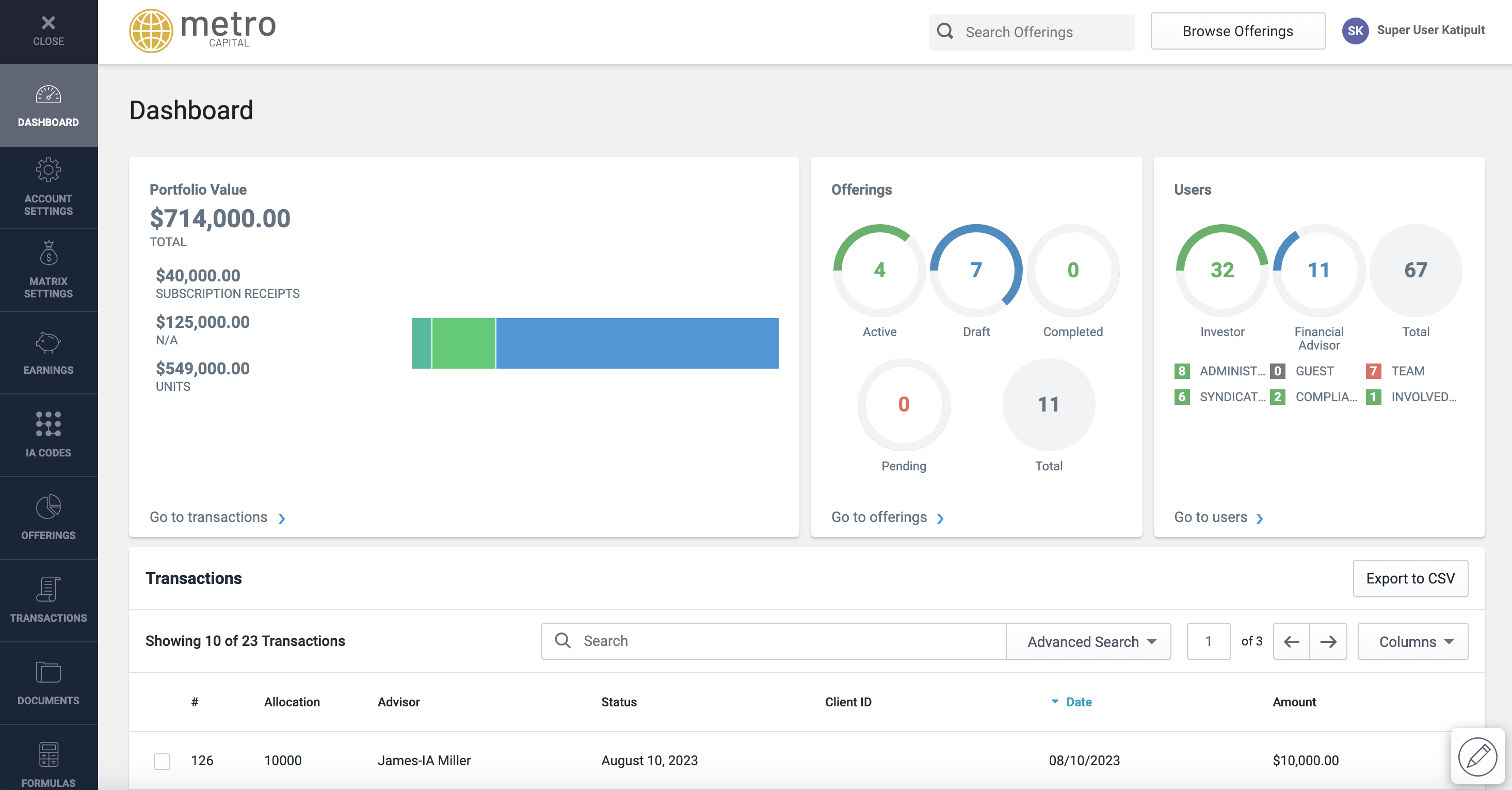

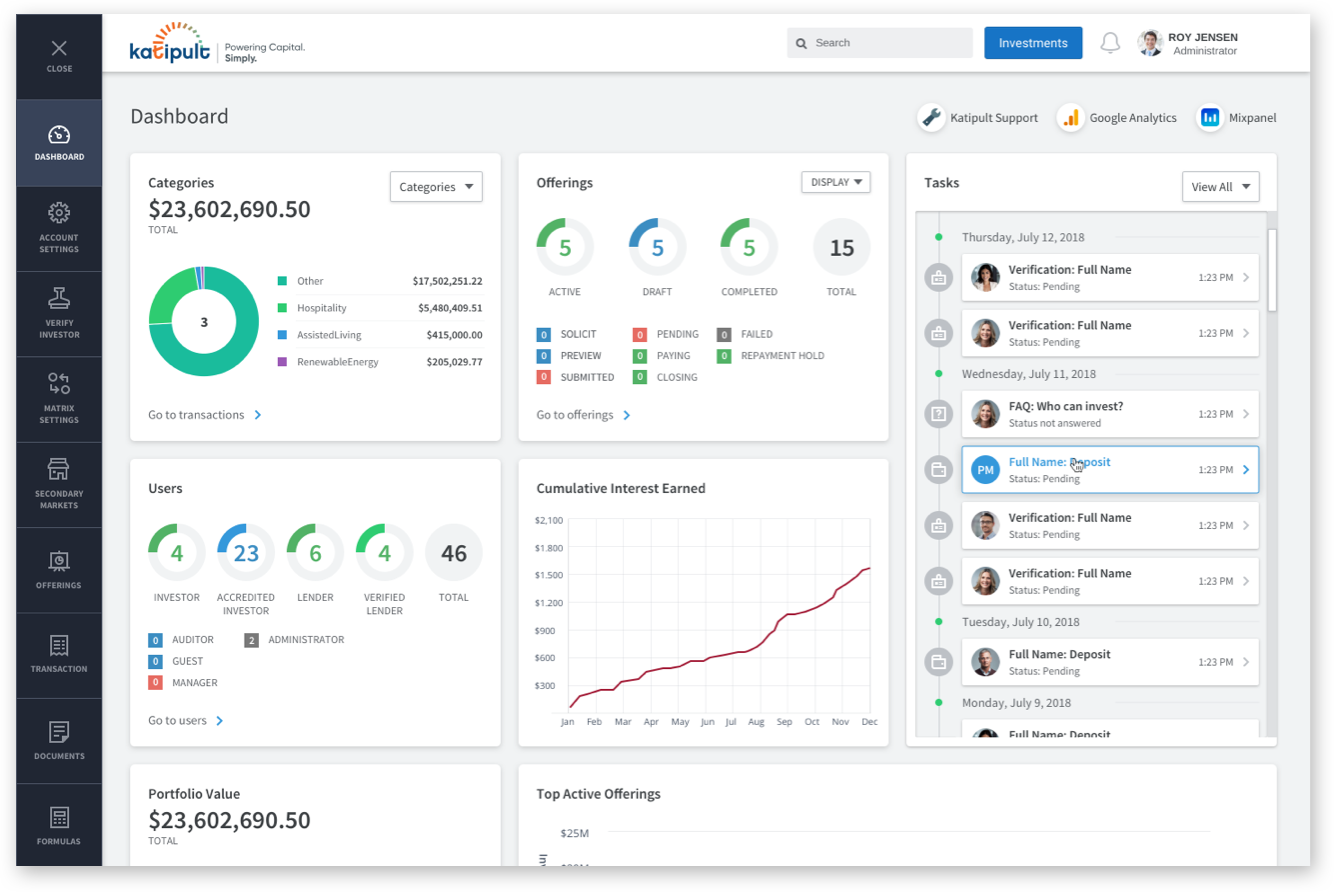

Book a DemoUsing DealFlow Core’s real-time dashboards, ECM teams can gain visibility into each deal’s progress without pulling manual reports from Excel sheets. This enables teams to prioritize which investors to engage with to close deals.

Book a Demo

By delivering a slicker, digital investor experience through DealFlow Core, including intuitive electronic signing, firms can retain and attract more Investment Advisors by providing improved tools to make it easier and quicker for investors to participate in deals.

Book a DemoUnderstanding the best-performing deal types and most engaged investor groups enables capital markets firms to hone and refine their business. Using DealFlow Core’s suite of reporting tools linked to a central data mart, teams can analyze performance faster than joining up multiple spreadsheets.

Book a Demo

DealFlow Marketing revolutionizes how you engage with investors, ensuring a more efficient, compliant, and practical approach to marketing investment opportunities.

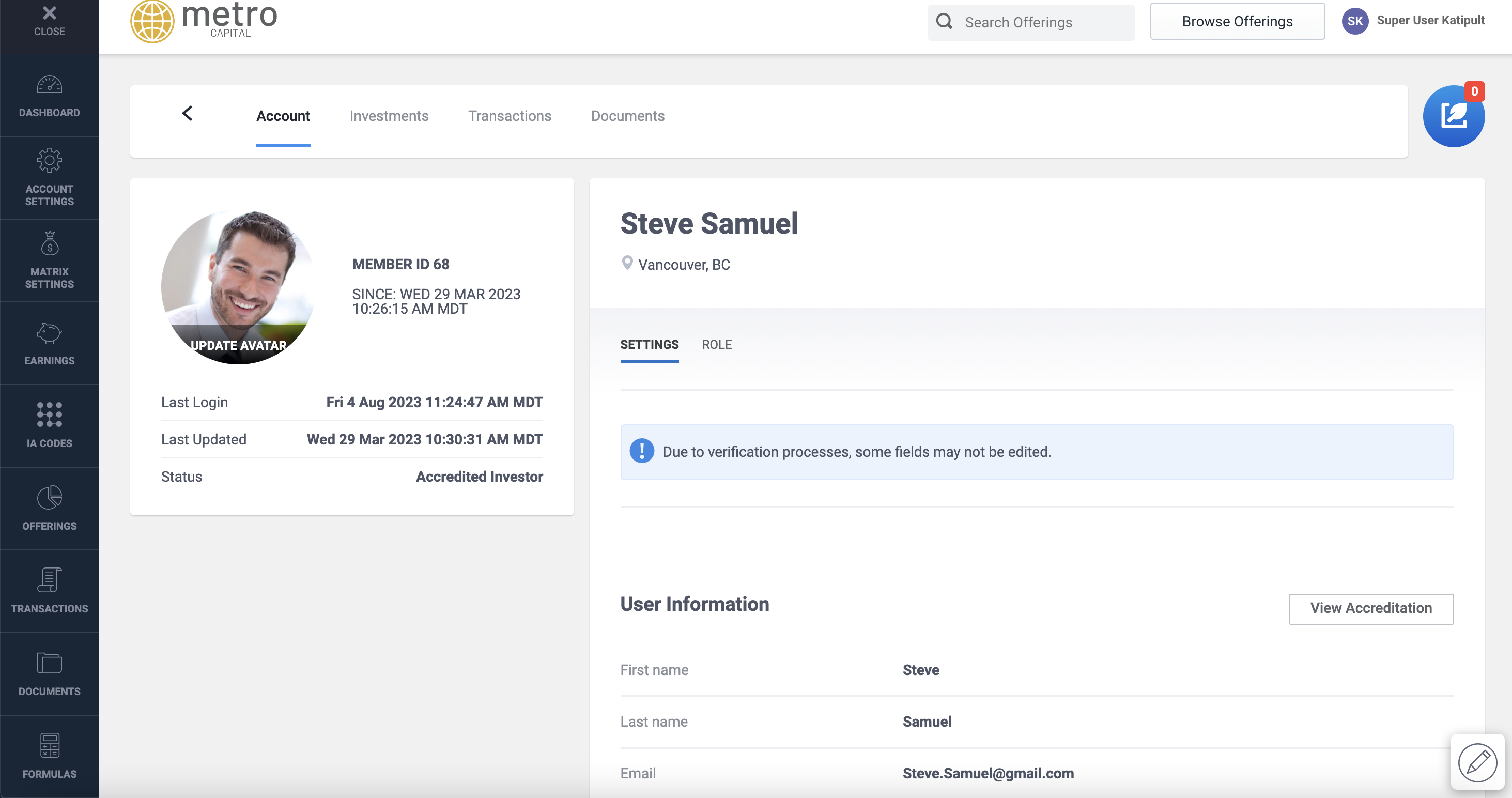

Onboard new clients quickly and easily with our DealFlow Accounts module. Learn more about how to automate KYC processes.

David Paris

Chief Operating Officer, ECM

Pat Burke

President, Capital Markets

Katipult DealFlow is changing the way that capital is raised with efficient and streamlined workflows which enable deals to close in days, not weeks or months.

Get answers to your unique questions, see the investment platform in action and discover why Katipult DealFlow is the right capital markets technology for your business.

900-903 8th Ave SW

Calgary, AB T2P 0P7