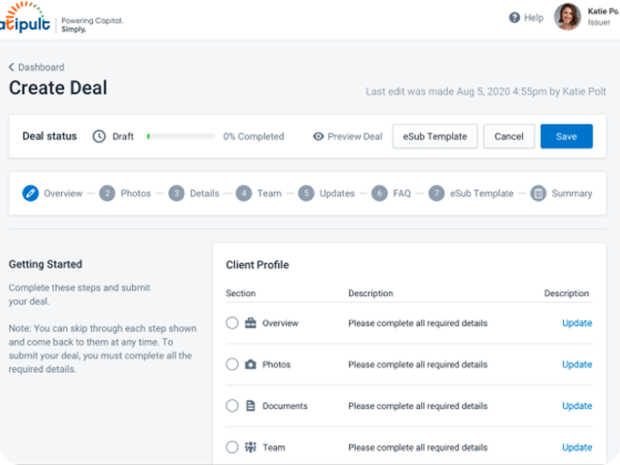

Use interactive deal templates to create private or public deal rooms in minutes

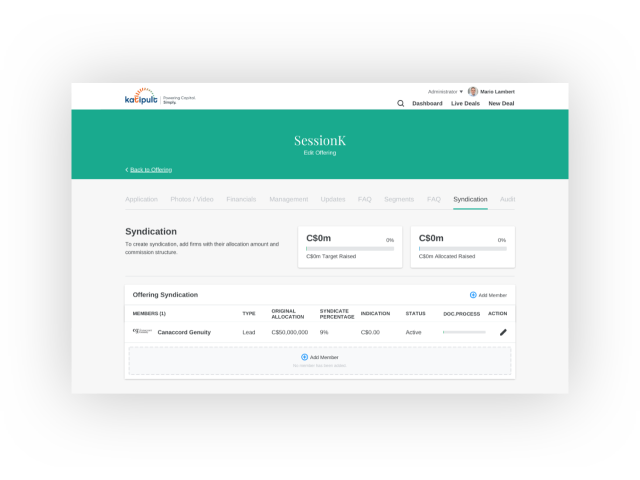

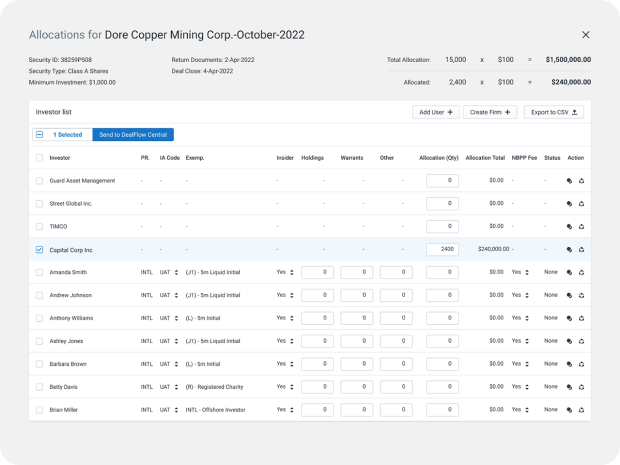

Build the book of syndicate participants and manage the expression of interest and final allocations

Set permissions for teams to access the deal room and their maximum investment allocations

Generate a purchasers list with all investor participation information and final documentation

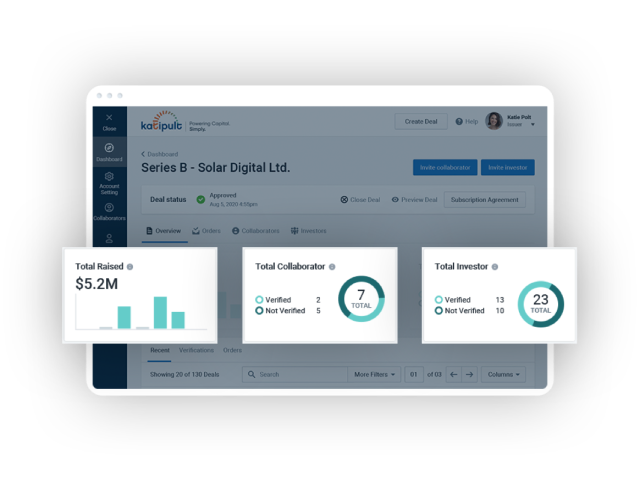

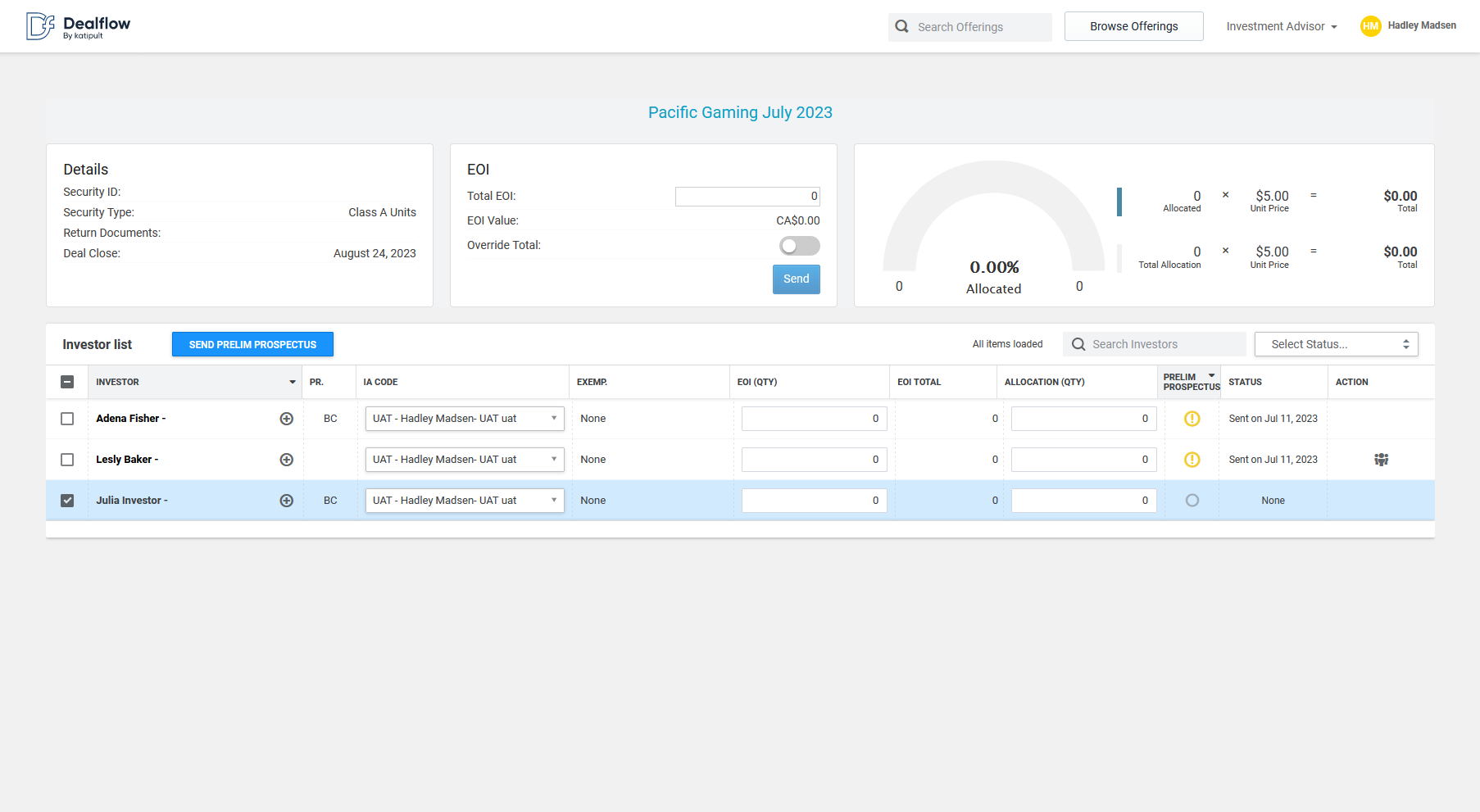

Review real-time deal activity to understand all completed and outstanding tasks required to complete the financing

Leverage distribution capabilities and compliance engine to rapidly send subscription documents, auto-completed for each investor

Powerful dashboards for alternative investment solutions that reflect key deal activities and metrics so teams can make informed decisions about pricing and allocation allotments. Configure specific dashboards for compliance, ECM and syndication, and client issuers to provide a holistic view of each capital raise and required action items.

Download Product GuideEnd-to-end cloud-based digital infrastructure to facilitate the creation, launch, and closing of new issue transactions with real-time updates. Katipult DealFlow delivers ease and efficiencies to the book runner and all syndicate members in public and private offerings.

Download Product Guide

Reporting and analytics that reflect key deal activities and metrics so teams can make informed decisions and drive engagement in real-time. Understand best-performing deal types, leading investors and other insights that can help drive performance.

Download Product GuideProcesses to drive efficiencies, dramatically reduce errors, and create compliance audit trails. Stay on the right side of regulation while, at the same time, opening deals to a broader number of investors.

Download Product Guide

David Paris

Chief Operating Officer, ECM

Pat Burke

President, Capital Markets

Drive deal flow and improve margins by leveraging highly efficient workflows that increase awareness and accessibility of deals across the firm.

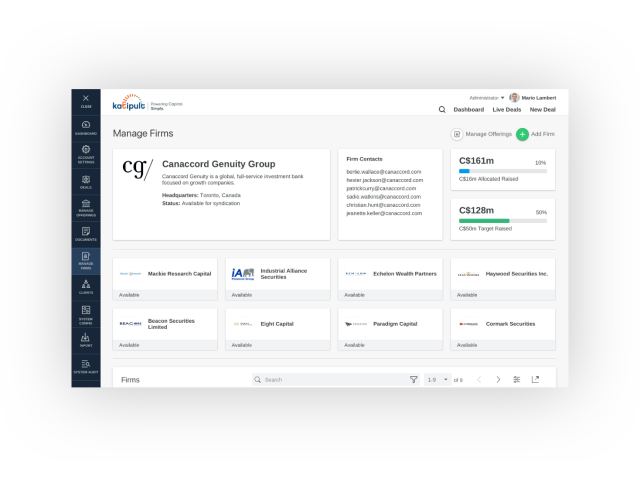

Introduce powerful tools so syndicate members and selling groups can execute deals quickly, close deals faster and earn more commissions.

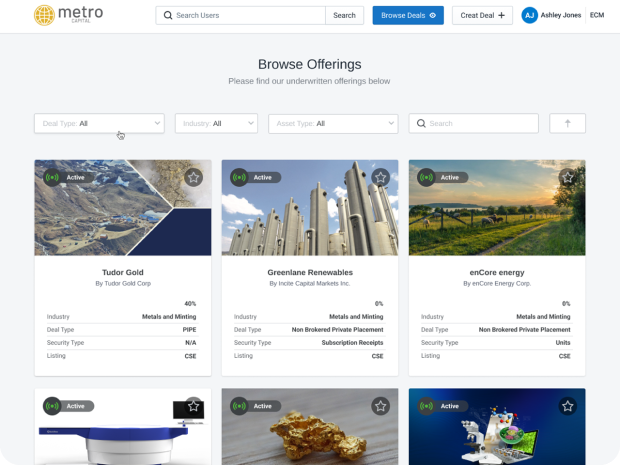

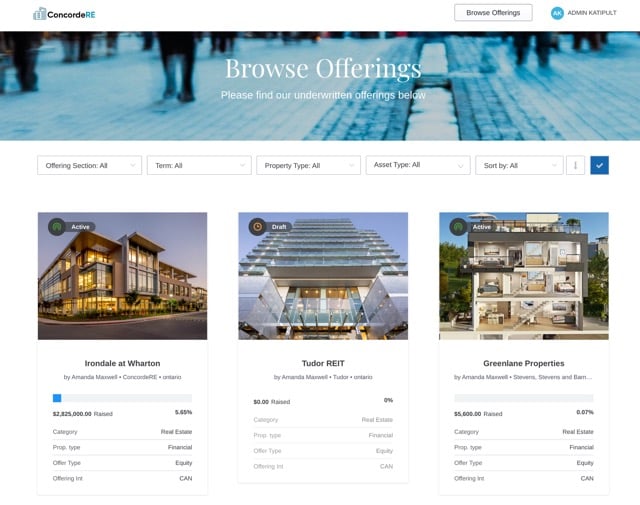

A centralized marketplace to showcase all alternative investments currently being offered. Increase awareness and accessibility to all stakeholder groups to drive more deal participation.

Ability to send and track readership of preliminary and final prospectuses to selected investors, and optional business rules to prevent allocations being made before documents are opened and read.

Easing the new issue process with our alternative investment solutions allows firms to leverage technology to offer a range of deal types, automate tasks, and achieve increased satisfaction from investors and issuers.

900-903 8th Ave SW

Calgary, AB T2P 0P7