As deal activity within capital markets increases, ECM teams are refining processes and upgrading their technology including investment platforms, positioning them to maximize the volume of deals they can run.

Distributing prospectuses is a time-consuming administrative activity that adds little value to the ECM team.

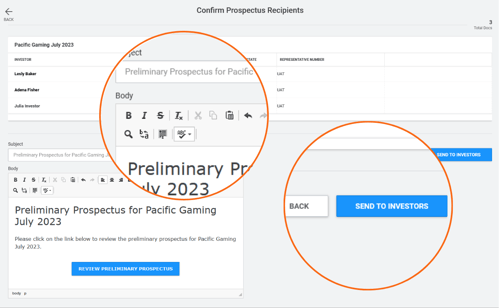

With Katipult’s new issue investment platform, we make it easy to manage these deals with features including;

- Send preliminary and final prospectuses

- Track and report distribution for compliance and audit reporting

- Configure business rules to optionally prevent allocations from being made before the preliminary prospectus is sent

Using Katipult DealFlow to distribute prospectuses reduces the administrative burden on ECM teams, enabling them to run more deals and generate more fees.

Final prospectus distribution is often subject to strict regulatory requirements. DealFlow's audit trail and reports enable dealers to demonstrate compliance.

.png?width=500&height=208&name=Prospectus%20distribution%20(2).png)

To learn more about prospectus distribution and the other benefits of the Katipult DealFlow investment platform, visit our investment platform page or contact Katipult today and book a demo.