Investments in private markets are seeing traction like never before - with that, brokers are growing their top line and breaking all-time deal volume records. However, this success has created stressors for Brokerage back-office teams, especially in the compliance function.

The traditional approach to scaling compliance efforts in the private placement process continues to be the most commonly used - when a broker is dealing with a larger deal volume, that equates to greater costs in the form of compliance headcount.

A growing number of brokers don’t see this approach as being sustainable. For the largest brokers, having to continuously add costly headcount to support operations is generating interest in alternative solutions. This is where Katipult comes in - our SaaS platform is built to automate and centralize every aspect of the private placement process including compliance management. At a high level, the improved process flow on Katipult follows this approach:

- The syndication team creates a private deal and uploads and tags a “smart” subscription agreement to dramatically improve subscription agreement accuracy and completion rates

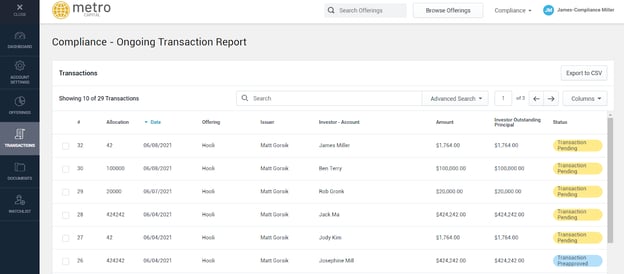

- These deals are assigned to advisors, and advisors in turn distribute allocations in the deals to their clients (investors) - the compliance team is given immediate visibility to the subscription documents that have been sent out

- As soon as the investor signs the subscription agreement, compliance is notified via email and within Katipult about a new document that requires review

In the model described above, compliance stays involved in the process throughout the deal lifecycle as opposed to after the deal is closed. What’s more, not only is visibility into the documents improved, teams also see a significant decrease in “not in good order” documents. Therefore, we see a double positive impact for compliance - a more transparent process, and fewer documents that are flagged for compliance review.

Delivering compliance through a digital platform paves the way for future intelligent workflows, for example, pre-emptively warning compliance of documents that may require review, and prioritizing document review based on complexity and investor usage of the platform.