Jan 2, 2025

As the financial sector continues to evolve, the integration of artificial intelligence (AI) is no longer a futuristic concept but a present-day reality driving significant transformation. At Katipult, we are committed to staying at the forefront of this innovation, and our recent project validation engagement with the Alberta Machine Intelligence Institute (Amii) underscores this commitment.

Oct 24, 2024

The financial industry is rapidly evolving, and in the coming years we expect artificial intelligence (AI) will further revolutionize the capital markets, providing efficiencies and enhancements that were previously unimaginable. At Katipult, we are at the forefront of this transformation, leveraging some of the greatest minds in the field of AI to study how to further streamline and improve the investor experience. Here, we explore 5 possible application areas of AI:

Oct 21, 2024

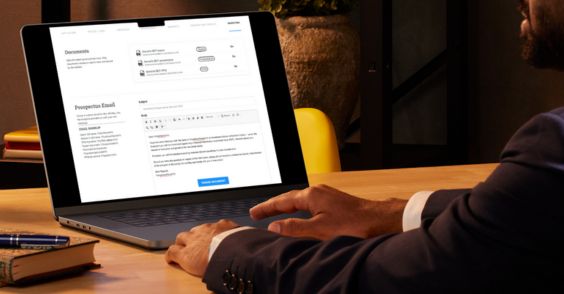

In today’s fast-paced financial landscape, efficiency and precision in managing public investment offerings are paramount. Katipult’s latest DealFlow release is tailored to meet these demands, offering enhanced capabilities that transform the way financial services firms handle syndication, investor engagement, and ticketing.

Aug 5, 2024

As financial advisors navigate an increasingly complex investment landscape, leveraging advanced software solutions is crucial. Katipult DealFlow stands out by streamlining critical investment workflows including private placements and prospectus offerings, but leveraging complementary software can further enhance its capabilities. Here are five key solutions that can transform your advisory services:

Jul 29, 2024

As the economy continues to evolve, certain industries are set to lead in capital raising, attracting significant investor interest. For registered broker-dealers, identifying these key sectors is crucial for strategizing and advising clients. Here are the top three industries expected to raise the most capital in the next two years:

Jul 22, 2024

Family Offices are experiencing a significant boom, driven by the need for personalized financial management and alternative investment strategies. With this growth comes the necessity for improved operational efficiency and preparedness for unforeseen circumstances, such as the sudden inability of a primary manager to continue their role. Utilizing advanced software solutions to engage with Family Offices can revolutionize how Family Offices participate in your deals.

Jul 15, 2024

In the fast-paced world of capital markets, leveraging technology to enhance investor relationships, improve experiences, and streamline processes is crucial. An investor CRM is one of the most important systems that can elevate your capital raising efforts. Here are the top five reasons why integrating an investor CRM can transform your fundraising strategy:

Mar 1, 2024

For years, investment dealers have had to bear the burden of distributing preliminary and final prospectuses to investors for public offerings. In addition to the costs associated with printing and mailing these documents, investment dealers must log final iterations of a prospectus. There is also administrative effort for Investment Advisors, who are responsible for sending their clients any amendments to preliminary or interim prospectuses.

Feb 20, 2024

Attracting investors to private deals requires a holistic approach that addresses their investment preferences, risk tolerance, and liquidity needs. By implementing these five strategies and incorporating actionable insights for each, Investment Advisors can effectively position private offerings as attractive investment opportunities in a competitive market environment.

900-903 8th Ave SW

Calgary, AB T2P 0P7