Nov 6, 2023

Sustainable investing has transformed from a passing trend to a pivotal consideration for investment firms and broker-dealers. The ascent of Environmental, Social, and Governance (ESG) criteria is reshaping investment strategies and influencing the financial landscape.

Oct 23, 2023

Understanding prevailing trends is crucial in the investment and mergers and acquisitions (M&A) landscape. A recent survey, “The 2023 Trends in Investing,”’ conducted by the Financial Planning Association (FPA), has unveiled insights into the changing dynamics of alternative investments and the state of global M&A. Additionally, research from the Alternative Investment Management Association (AIMA) sheds light on emerging trends in private credit that align with the survey findings.

Oct 17, 2023

The annual ADISA conference in Las Vegas is always an excellent opportunity to catch up with sponsors, managing brokers and other stakeholders in the alternative investments industry. The conference also had some insightful educational tracks highlighting several challenges we are actively focused on solving for our customers with Katipult DealFlow.

Sep 27, 2023

On August 23, 2023, the U.S. Securities and Exchange Commission (SEC) announced a momentous change to the $20 trillion private fund industry. The SEC unveiled a sweeping set of reforms aimed at reshaping the landscape of this segment of the alternative investments sector. These regulatory changes carry far-reaching implications for broker-dealers, private fund managers, and investors.

Sep 11, 2023

There has been an increasing trend of private equity real estate sponsors and fund managers embracing technology such as investment platfoms to expand their digital capabilities and distribution channels. An overarching theme of these initiatives is to enhance accessibility for investors and financial advisors to buy, own, and sell real estate investments online.

Sep 1, 2023

Wealth Management is rapidly transforming as securities deregulation, disintermediation, investor demographics, technology, and accessibility to new investment products drive fundamental changes to the industry. As these changes accelerate, financial advisors have to deliver strategies that justify fees and provide a differentiated service for their clients otherwise, they risk losing business to low-cost, self-administered brokerage accounts, robo advisors, and the growing number of ETF options.

Aug 17, 2023

Institutional investors stand as formidable pillars, commanding vast pools of capital and exerting a profound influence on global capital markets. These sophisticated and well-funded entities, including pension funds, insurance companies, sovereign wealth funds, and endowments, are pivotal in shaping economies and businesses' trajectories.

Jul 26, 2023

In 2019, both Capital One and Empire Life experienced data breaches where cybercriminals gained unauthorized access to systems containing the personal information of over 100 million clients. A few years earlier, in 2014, JPMorgan Chase experienced a significant data breach. Hackers accessed the bank's systems and compromised the personal information of approximately 83 million customers.

Jul 24, 2023

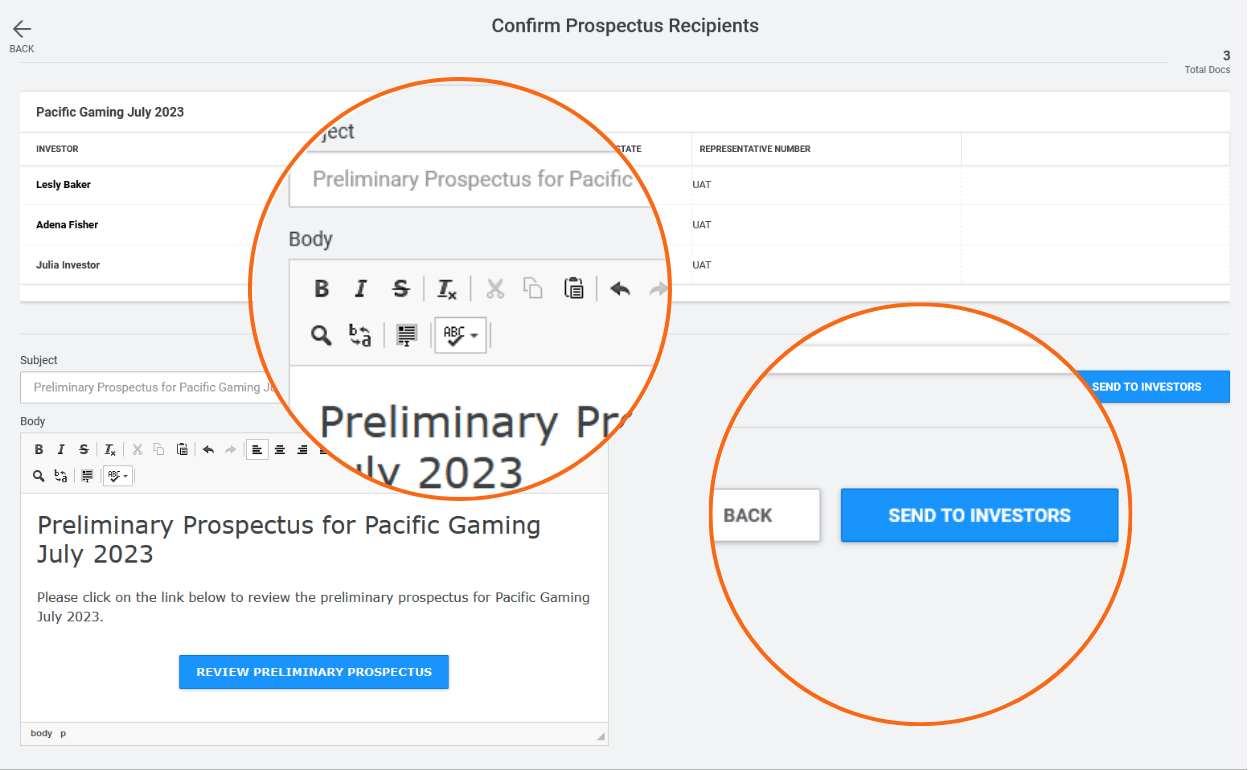

As deal activity within capital markets increases, ECM teams are refining processes and upgrading their technology including investment platforms, positioning them to maximize the volume of deals they can run.

900-903 8th Ave SW

Calgary, AB T2P 0P7