Aug 2, 2022

Our CEO Gord Breese sat down with Martin Gagel of Market Research Radius to discuss Katipult's recent customer milestones, product updates, and strategic opportunities for the company.

Jun 27, 2022

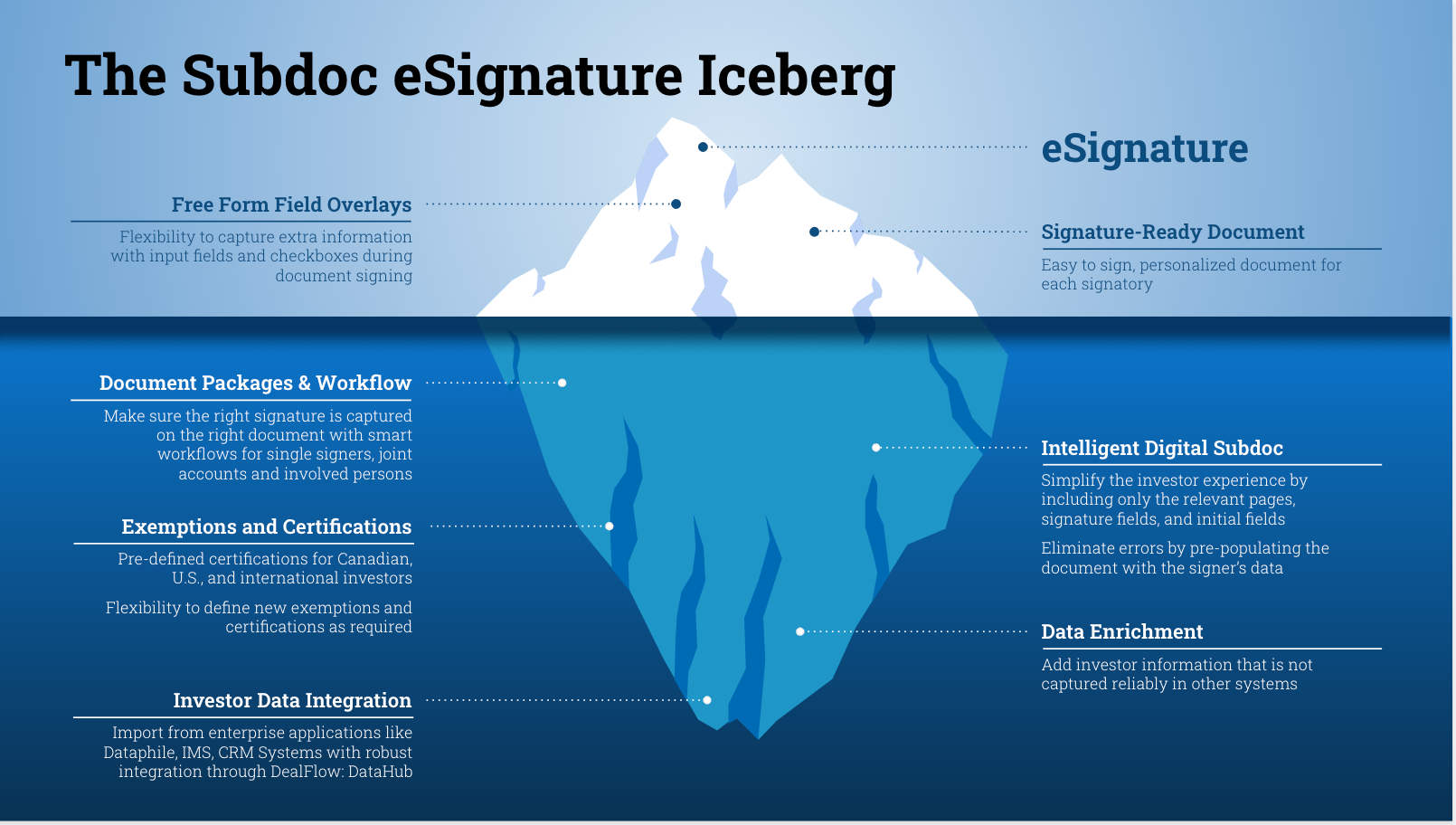

As retail participation in private placements grows, more investors are filling in complex subscription agreements that they are not familiar with. This leads to back and forth between advisors and investors correcting errors on ‘not-in-good-order’ documents. Existing manual processes are struggling to keep up, and dealers are asking themselves if there is a better way.

Mar 14, 2022

Private real estate. Hedge funds. Commodities. Cryptocurrencies. Private equity. These are just a few types of investments broadly classified under the umbrella of “alternative investments”. And it is an umbrella that is quickly growing, with total assets under management in alternatives blowing past the $9 trillion mark in 2021. Just five years ago, this figure was closer to $4 trillion.

Mar 8, 2022

In the private placements world, syndicated deals are the “big fish” everybody is aiming for. Deal sizes, commissions, and the credibility boosts are much larger. The problem? So are their complexities and inefficiencies.

Feb 2, 2022

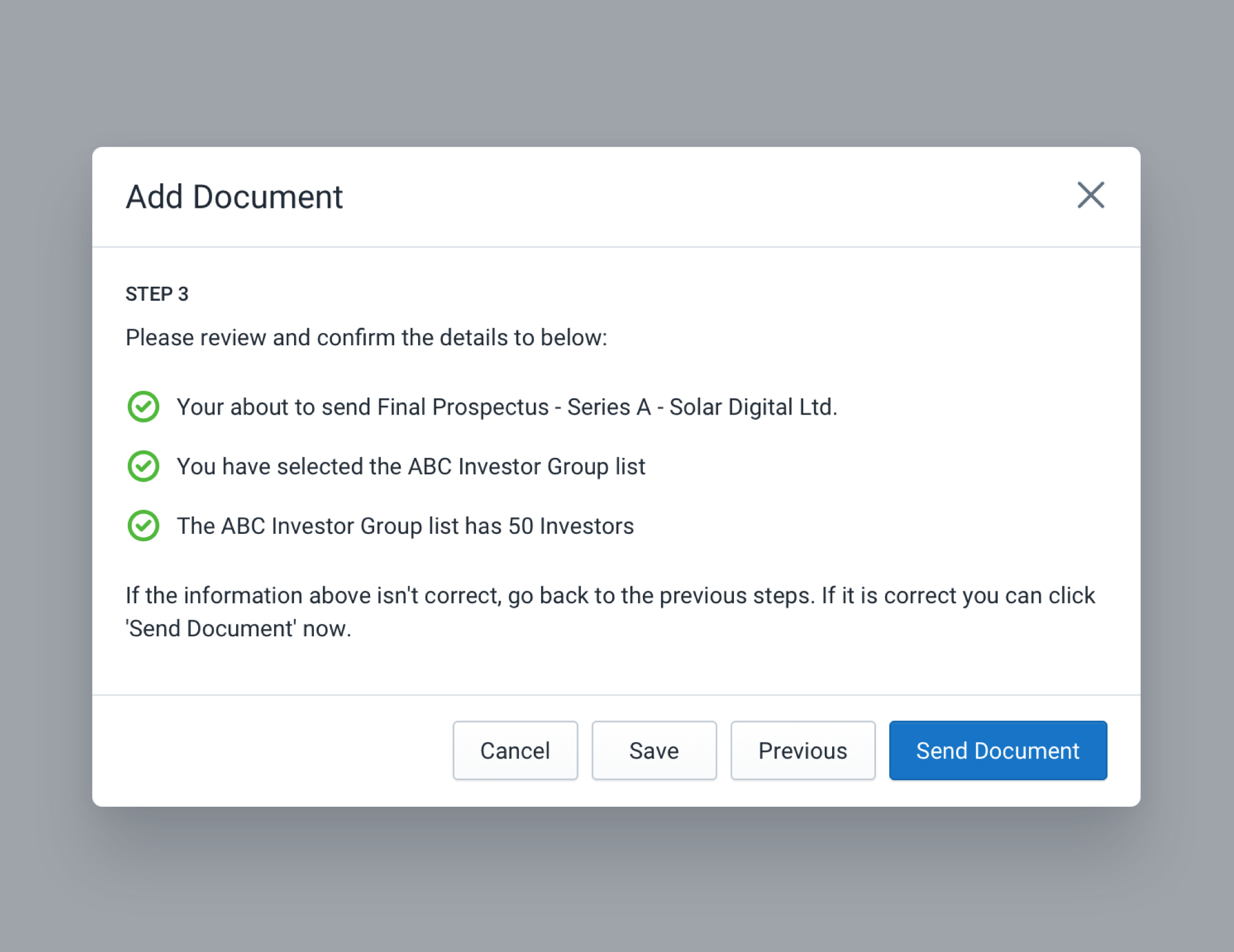

As we move into 2022, we wanted to highlight a few of the major product updates that are being released in 1Q22 and preview what’s next in our roadmap.

Jan 17, 2022

Nineteen. That’s approximately the number of paper forms an institutional investor interested in subscribing to a private placement must fill out. From certifying beneficial ownership to confirmations that they have sufficient anti-money laundering guidelines, even getting past the first step can be a major hurdle.

Jan 10, 2022

Investment advisors today face one key challenge – creating value in ways that can resist the increasing commoditization of wealth management. Decades ago, executing simple stock market trades were expensive affairs requiring calls placed to a broker (who often also provided stock recommendations). Now, they are commoditized affairs where the main differentiator is price.

Nov 29, 2021

Are financial services companies fully harnessing the power of intelligent workflows in the private capital markets? Or are they being left behind?

Nov 16, 2021

Today, financial institutions must contend with the accelerated rise of the three ‘Cs’ – competition, compliance, and costs.

900-903 8th Ave SW

Calgary, AB T2P 0P7