Nov 2, 2021

Software is eating the world. These were the words investor Marc Andreessen – cofounder of prominent venture capital firm Andreesen Horowitz – wrote back in 2011. In the ten years since, much of his proclamation has come true. Netflix disrupted cable, Airbnb disrupted hotels, Uber disrupted taxis. And fintech is disrupting wealth management.

Oct 4, 2021

The pandemic caused widespread disruptions to global supply chains, leading to shortages and supply shocks for many goods. Although not a physical good per se, we see a similar thing happening in the private placements market.

Sep 23, 2021

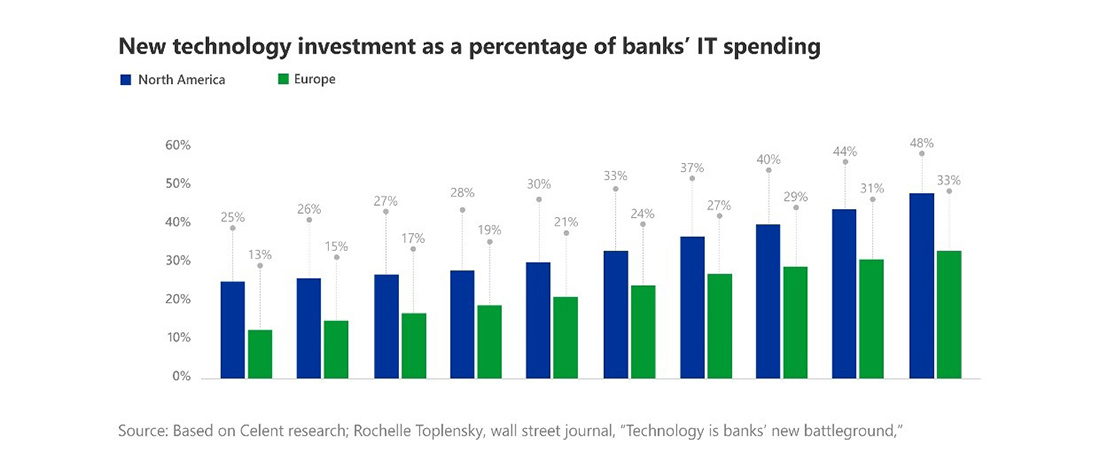

Financial institutions today face a battle on two fronts. The first front is rising competition – especially from the fast-growing fintech industry which continually strives to encroach on incumbents’ territory. Nimble and digital, these upstarts are unencumbered by legacy systems and processes, giving them a powerful advantage in their quest for market share.

Jun 23, 2021

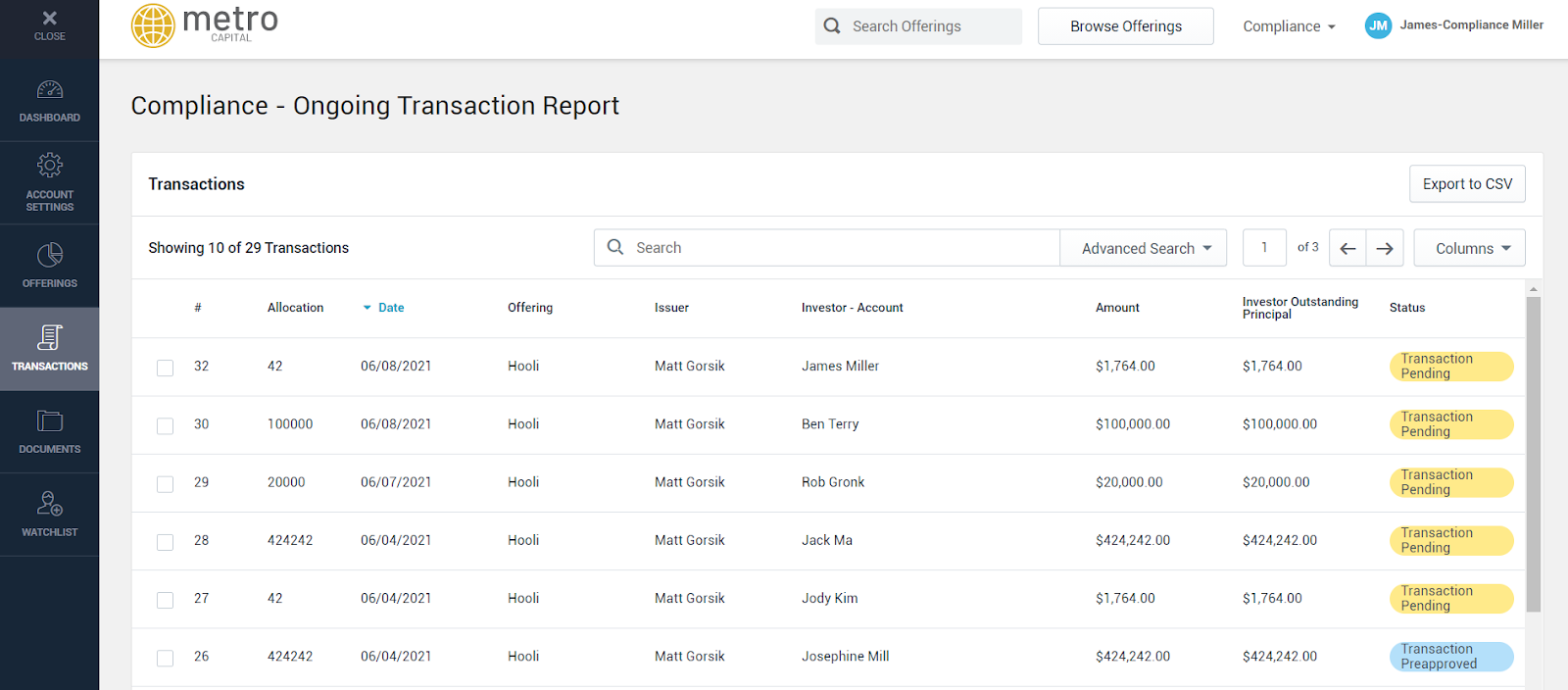

Investments in private markets are seeing traction like never before - with that, brokers are growing their top line and breaking all-time deal volume records. However, this success has created stressors for Brokerage back-office teams, especially in the compliance function.

Mar 31, 2021

The technological advancements we’ve been experiencing for the past few decades have had a profound impact on various industries. Entertainment, Retailers, Health Care, and many other industries have all adopted a tech-centered approach to their business models.

Mar 24, 2021

Canaccord Genuity to leverage Katipult's technology offering as a digital complement to its capital raising and private placement capabilities

We are pleased to announce that Katipult has entered into a multi-year software license agreement and strategic co-marketing agreement with Canaccord Genuity.

The agreements support Katipult's growth and market expansion plans with a focus on strengthening its market position in Canada and expanding its presence in the U.S., UK and Australian capital markets.

Mar 11, 2021

Katipult is pleased to announce the addition of Raymond James & Associates, Inc. to its growing customer list.

Mar 4, 2021

In February 2021 we saw Game Stop stock headlines bringing retail investors into the focus of mainstream media. Although this specific case seems to have polarized the market commentary, it undoubtedly made everyone realize how much power this group of investors can have.

Feb 16, 2021

Katipult is proud to announce that it has entered into an agreement with Canaccord Genuity, a global leader in capital markets and wealth management, for a $3.0 million corporate investment in Katipult.

900-903 8th Ave SW

Calgary, AB T2P 0P7