Feb 8, 2021

Katipult Co-Founder Brock Murray and VP of Solution Engineering Karan Khiani joined the Fintech Fridays Podcast hosted by NCFA. They discussed a variety of topics such as going public early, evolving the product to meet complex requirements, and recognizing emerging retail investor trends.

Feb 2, 2021

Jan 29, 2021

Katipult CEO, Gord Breese, sat down for an interview with Berk Sumen, head of TSX company services for their “C-Suite at The Open” series. In an effort to highlight the “unique stories and perspectives of companies listed on Toronto Stock Exchange (TSX)”, the conversation touched on both Katipult’s business model as well as the future growth outlook.

Jan 26, 2021

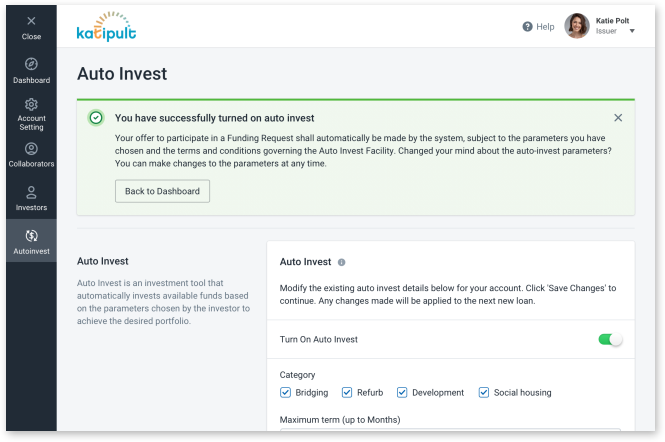

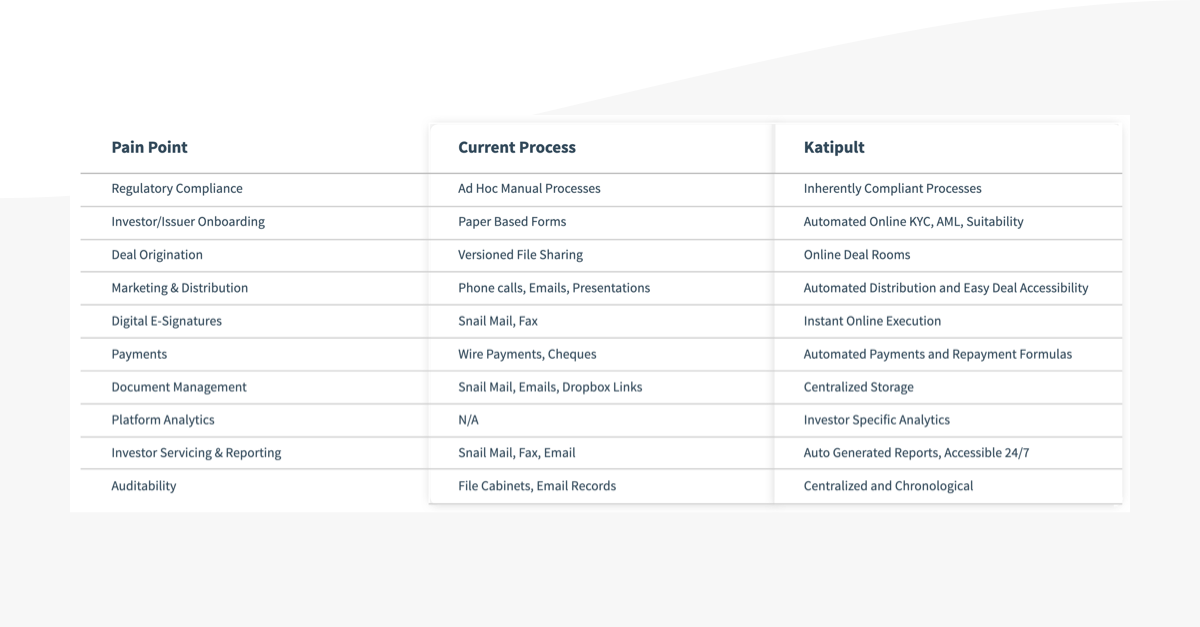

A cloud-based lending platform is the heart of your online deal syndication service. It impacts every area of your business from investor servicing to loan servicing. It’s the primary way that your investors interact with your firm to access new opportunities and allocate their funds. It also scales the amount of loan administration your team can do, opening up growth possibilities for the business.

Dec 3, 2020

We are pleased to announce the addition of Mr. Karan Khiani as the Company's Vice President of Solutions Engineering and Mr. William Van Horne as the Company's Corporate Secretary.

Dec 1, 2020

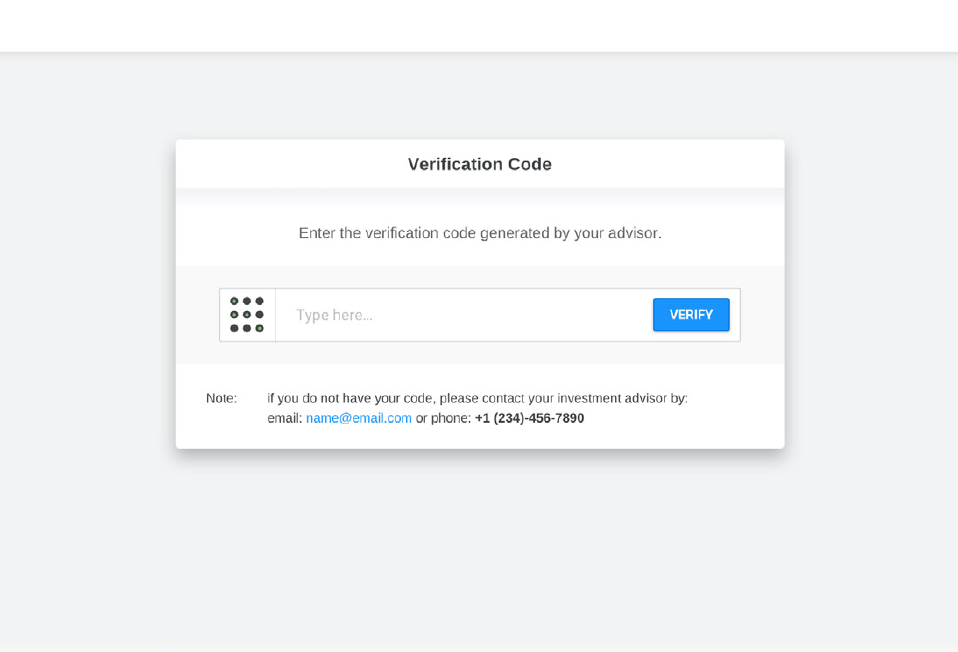

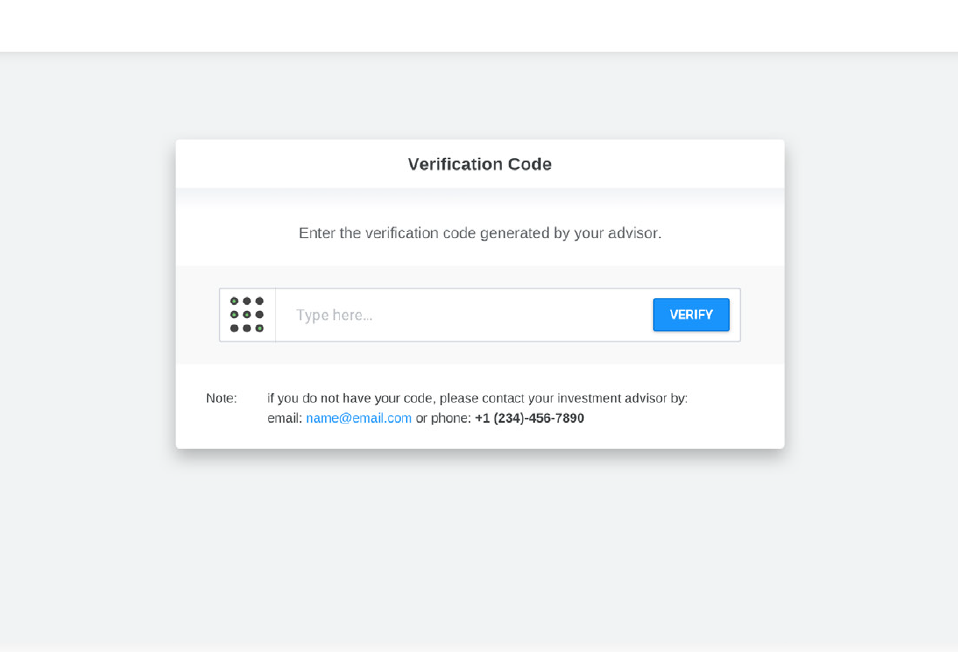

Electronic signatures have been around for some time, and even though their use can drastically streamline paperwork and save time, organizations in the investment industry have been surprisingly slow to adopt them.

Nov 12, 2020

Digital transformation is rapidly changing the way the investment industry does business and interfaces with their customers. Among the highest priorities for leading firms is the adoption of electronic or digital signatures rather than “wet” signatures. By introducing electronic signatures, the firm can move away from manual and paper-based, ad hoc processes that are plagued with deficiencies, compliance risks, and frustrations by all those involved.

Nov 5, 2020

The US Security Exchange Commission (SEC) has finally reached a decision to implement proposed amendments to the exempt offerings framework. These changes have been advocated by numerous groups over the last few years to increase activity and interest in these progressive regulations, particularly by larger and more established investment dealers.

Apr 2, 2020

As social distancing and remote working become a reality for firms in capital markets, those with strong digital operations will thrive and out-maneuver their peers in the near while developing a significant competitive advantage in the long term.

900-903 8th Ave SW

Calgary, AB T2P 0P7