The annual ADISA conference in Las Vegas is always an excellent opportunity to catch up with sponsors, managing brokers and other stakeholders in the alternative investments industry. The conference also had some insightful educational tracks highlighting several challenges we are actively focused on solving for our customers with Katipult DealFlow.

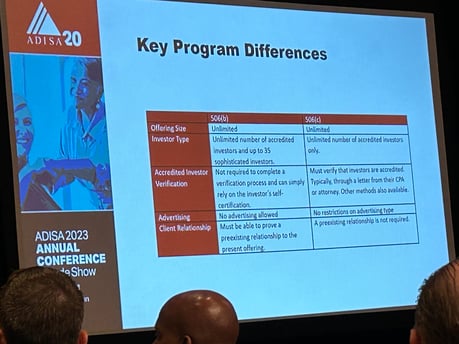

One of the most interesting sessions was on Tuesday morning on reasons for choosing 506(b) or 506(c) as a preferred offering type, which John Grady moderated from ABR Dynamic Funds.

It is a challenge we know well; while both programs are unlimited in offering size, 506(b) is restricted to up to 35 ‘sophisticated investors’. 506(c), on the other hand, has no limit on the number of investors, nor must there be a pre-existing relationship with the issuer.

It is a challenge we know well; while both programs are unlimited in offering size, 506(b) is restricted to up to 35 ‘sophisticated investors’. 506(c), on the other hand, has no limit on the number of investors, nor must there be a pre-existing relationship with the issuer.

The panel, including Dave Laga from DFPG Investments, Amy Arnold and Kimberlee Levy both from Concorde, reminded delegates that it was important to remember that investors must be accredited, which brings due diligence and compliance challenges to ensure that deal participants are verified as accredited investors.

Key differences exist in how deals under the different programs can be marketed. The regulations are clear that 506(b) deals cannot be advertised, while 506(c) deals can be advertised, something broker-dealers using DealFlow Marketing can do seamlessly when creating deals.

We are familiar with this problem through work with a major US financial institution. Using Katipult DealFlow, this firm has run 506(c) offerings without enforcement actions while at the same time optimizing deals to close faster by using DealFlow to automate and digitize workflows.

The session about REITS, moderated by Craig Merkt from Carlton & Associates, highlighted another challenge we are solving for Katipult customers. The Tuesday afternoon session on the myths of NAV REIT highlighted the importance of real estate as an alternative investment class.

Dominic Vaccaro from Burlington Capital was on the panel and made some excellent points around the liquidity of the perpetual life NAV offering, which aligned with our work to allow secondary trading of alternative investments.

Finally, the session focussed on Energy Assets of the Future and reflected trends across our platform in Canada and the US. While Katipult DealFlow can handle deals across any sector, the ability to rapidly launch new issues for clean energy investments and mineral exploration–critical for the electrification of transportation–gives broker-dealers using DealFlow an advantage.