May 28, 2018

SWIFT Business Forum Canada gathered over 340 financial service leaders to discuss the opportunities and threats of rapid technological advancement across the financial ecosystem in Canada.

Our CIO, Ben Cadieux, was one of the panelists for “Shaping the Future: Innovation in Action” together with Tim Hogarth, VP of Innovation Strategies and Framework at TD Bank Group, and Nicholas Bayley, Managing Director of Accenture Strategy at Accenture Canada. The panel was moderated by Ryan Masters, Executive Director & Strategic Relationship Manager at SWIFT.

The panel was aiming to uncover how leaders are shaping the future of financial services by strategically employing new technologies, successfully utilizing information and Big Data, and reshaping their infrastructures.

Here are the 5 key takeaways from the panel “Shaping the Future: Innovation in Action” on SWIFT Business Forum Canada 2018:

May 10, 2018

Katipult took part in the inaugural Tokenomx crypto conference in Chiang Mai, Thailand at the Le Meridien Hotel on April 18-19, 2018. Katipult also co-hosted a Speaker Dinner event with its Thailand-based customer iLab, at the highly acclaimed David’s Kitchen for all VIP ticket holders, speakers, and sponsors from Tokenomx. Over 100 people showed up for the event.

Apr 30, 2018

As our firm continues to explore the global opportunities in major financial centers, we are excited to have recently added two regulated firms from the United Arab Emirates (UAE), including a subsidiary of a publicly listed entity on the Abu Dhabi Securities Exchange. This milestone starts our coverage of the UAE and cooperation to adhere to the regulatory requirements in the country.

Apr 26, 2018

The GDPR (General Data Protection Regulation) is a new regulation for organizations dealing with data from EU citizens. In this article, we’ll discuss how the GDPR affects Katipult platforms and the necessary steps to make the platforms GDPR compliant.

Apr 20, 2018

In today’s interview with our Board Members, we talked to David Jaques, the first CFO for PayPal. David serves as Chair of Compensation and Governance Committee and Member of Audit Committee for Katipult.

In his early career, Mr. Jaques held various positions with Barclays Bank in London and provided advisory services in currency and interest rate risk management to the bank’s corporate clients. He held a similar role at Barclays Bank, New York from 1988 to 1993. One of his most notable positions was as the first CFO for PayPal from 1999 to 2001 where he established PayPal’s financial planning and accounting processes.

Apr 18, 2018

Know Your Customer (KYC) is a standard due diligence process used by investment firms i.e., wealth management, broker dealers, private lenders, commercial real estate investment, among others to assess investors they are conducting business with. Apart from being a legal and regulatory requirement, KYC is a good business practice as well to better understand investment objectives and suitability, and reduce risk from suspicious activities.

Mar 20, 2018

Katipult is pleased to announce its panel participation in the SWIFT Business Forum Canada on March 21st, 2018 in Toronto Canada, joining industry heavyweights TD Bank and Accenture, to discuss the future of financial services and the transformation of their infrastructure.

Mar 19, 2018

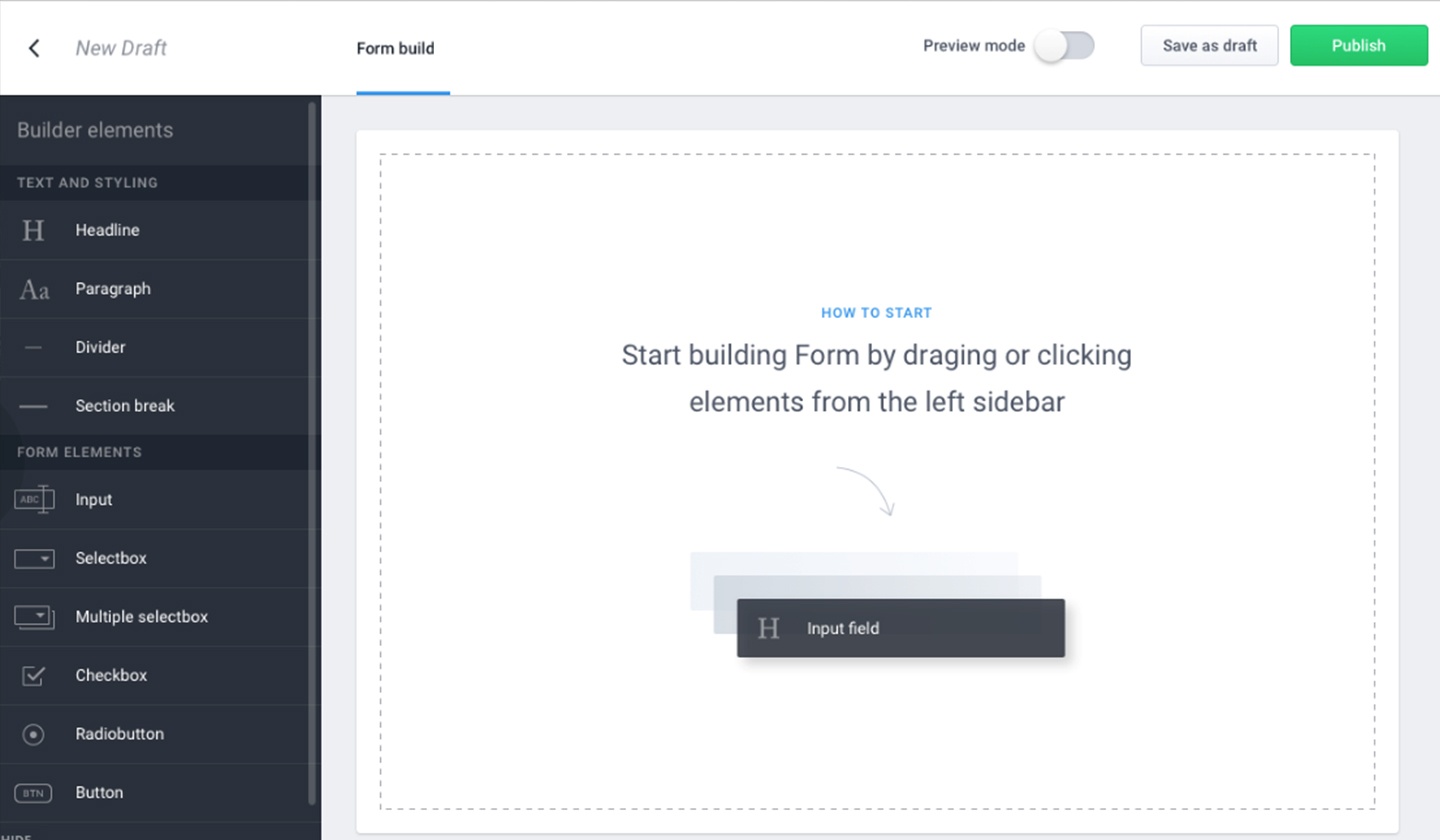

Katipult announces addition of proprietary Dynamic Form Builder module to enable rapid implementation of highly sophisticated user and investment onboarding forms. No coding needed! Build custom investor and issuer onboarding forms as well as custom project and loan applications. As easy as your favorite form building products Google Forms and Wufoo.

There is already a number of customers that are part of the pilot project and that have started using the new Dynamic Form Builder feature within their platforms, including MaRS VX. You can learn more how MaRS VX is integrating the Form Builder with their SVX platform in our press release.

Here are some of the most important features of the Dynamic Form Builder:

Mar 16, 2018

We've partnered with Jor Law, a co-founder of VerifyInvestor to present a webinar on how to find accredited investors and best practices of verifying them.

900-903 8th Ave SW

Calgary, AB T2P 0P7