Katipult DealFlow powers the exchange of capital in equity and debt markets. Our cloud-based investment platform digitizes workflows, strengthens regulatory compliance, accelerates deal flow, and provides seamless investor experience.

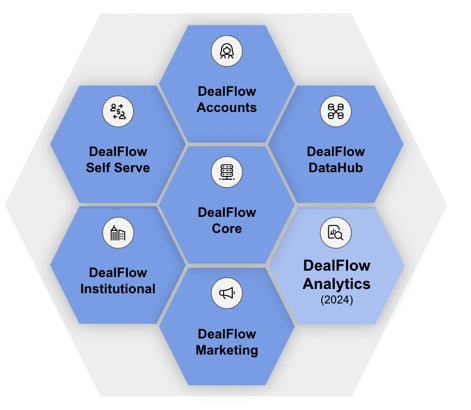

Katipult DealFlow is a modular SaaS Fintech investment platform, purpose-built for investment firms. The product comprises modules designed to provide solutions for critical workflows in the operation for new issues in capital markets.

DealFlow Core sits at the heart of the system, providing operational workflow for new issues, deal management tools, and Katipult's proprietary e-signature solution. An investment firm can easily add modules to deliver institutional workflows, secure marketing information distribution, or account onboarding based on its business profile and requirements.

DealFlow Core

Digitize private placements and prospectus offerings for the retail wealth distribution channel.

Learn More

DealFlow Accounts

Retail and institutional account opening with compliance approval.

Learn More

DealFlow Institutional

Launch sub-doc and allocation management to institutional investors.

Learn More

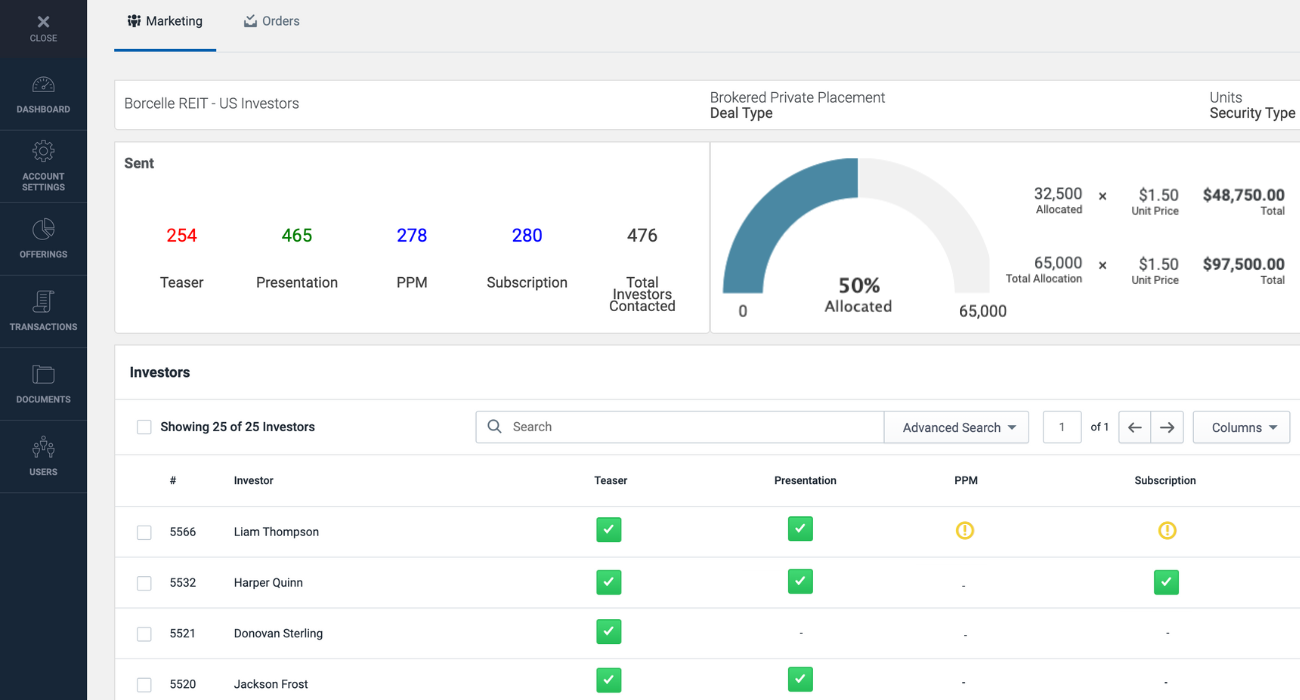

DealFlow Marketing

Enhanced marketing campaign management to retail and institutional investors.

Learn More

Katipult DealFlow provides a state-of-the-art, cloud-based infrastructure.

For investment firms, this means the ability to access the system from any location, on any device, enabling dealers to launch deals for issuers at the optimum time and Investment Advisors to be more responsive to enable clients to participate in high-quality deals and opportunities.

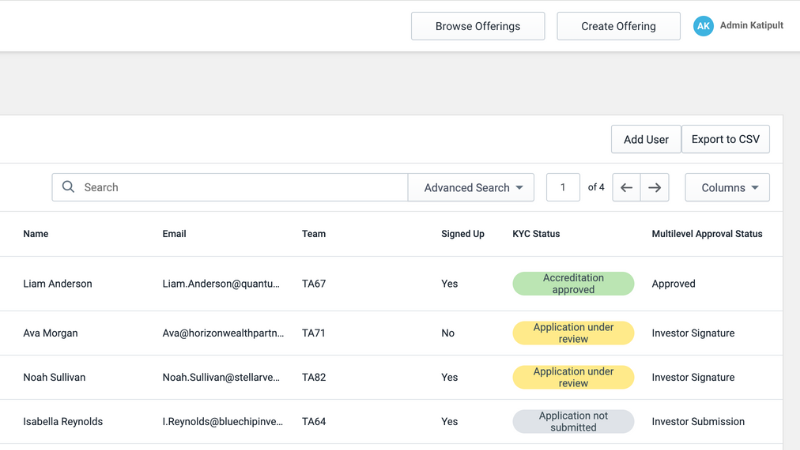

Book a DemoKatipult DealFlow is truly a firm-wide solution. Investment Advisors have dedicated workflows and tasks to manage institutional and retail investor engagement.

Equity Capital Markets teams have tools to manage deals, while Compliance teams benefit from the automation of AML, KYC, and other regulatory requirements.

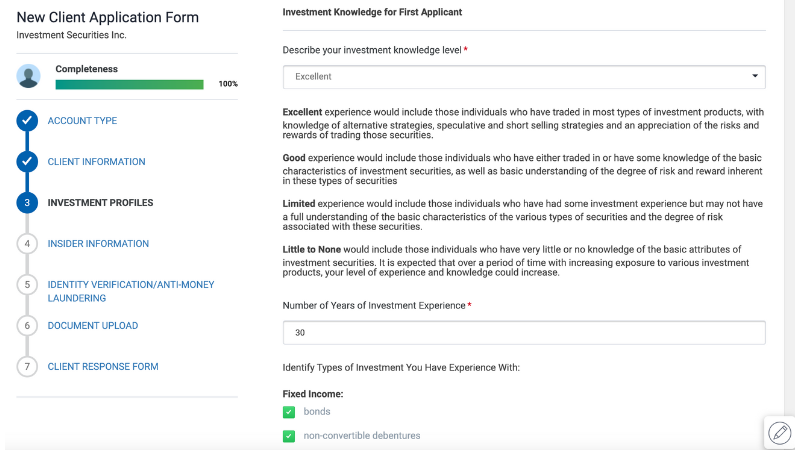

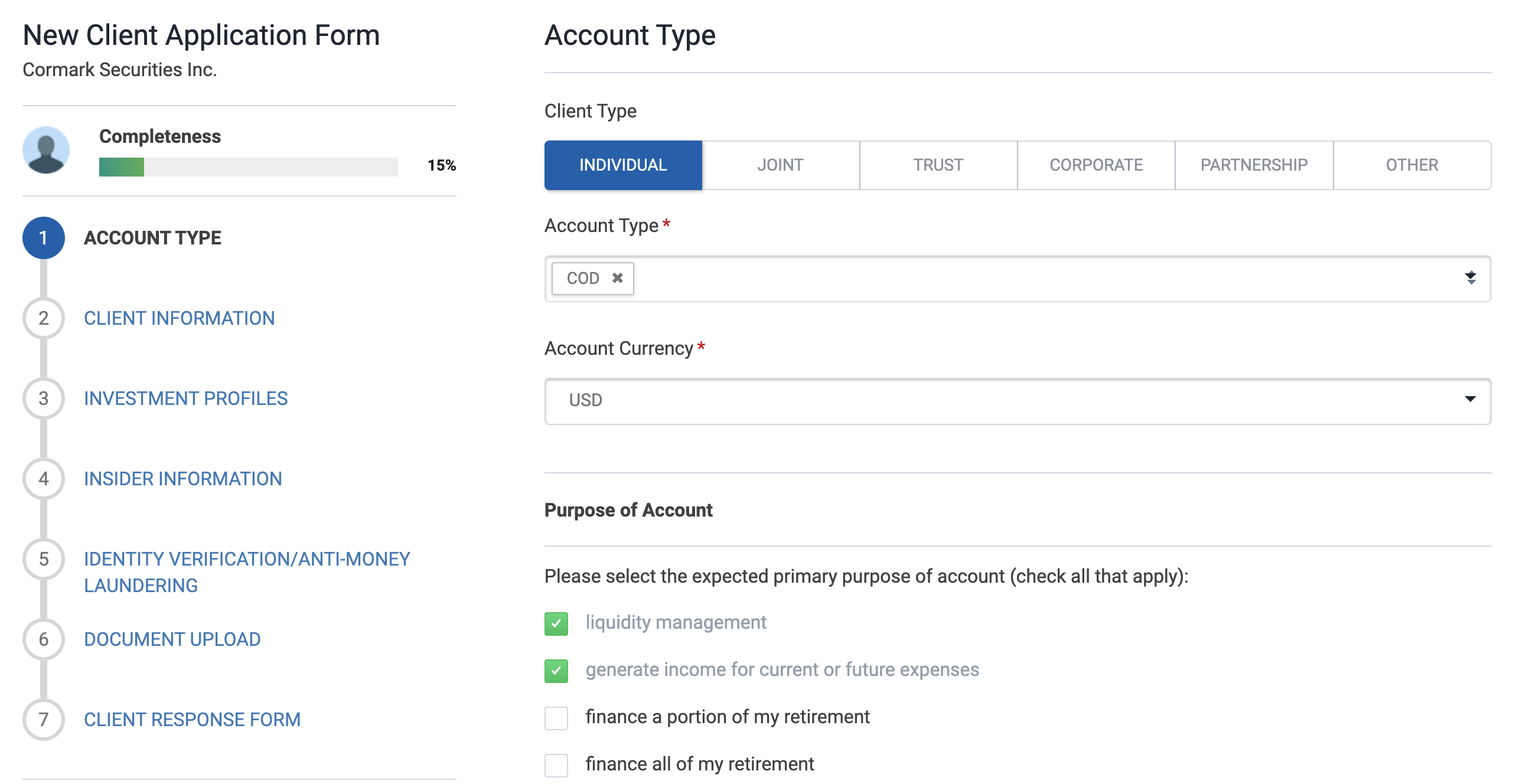

New accounts teams benefit from smart forms to quickly and frictionlessly onboard new clients.

Book a Demo

When creating accounts, investors can select different account types including Individual, Corporate, Trust, and Joint to accommodate both retail and institutional investors.

DealFlow Accounts will intelligently update form fields and tax documentation accordingly, making the onboarding process intuitive and highly automated for investors.

Katipult DealFlow has been created from the ground up to meet the requirements of investment firms and professionals.

Our leadership team has decades of experience in capital markets, and our product roadmap has been developed in collaboration with customers to deliver against the requirements of leading investment firms in North America.

Book a Demo

The DealFlow Core product guide includes key information about the investment platform's benefits and features.

The DealFlow Accounts product guide outlines how the product can help firms onboard clients quickly and easily

David Paris

Chief Operating Officer, ECM

Pat Burke

President, Capital Markets

Katipult DealFlow is changing the way that capital is raised with efficient and streamlined workflows which enable deals to close in days, not weeks or months.

Get answers to your unique questions, see the investment platform in action and discover why Katipult DealFlow is the right capital markets technology for your business.

900-903 8th Ave SW

Calgary, AB T2P 0P7