One of the issues with private markets is that liquidity can be difficult. For investors , there are situations when they have taken equity or debt positions in a company or investment product but have been unable to withdraw their investment.

Life brings challenges, and sometimes a shareholder is better off with cash than with shares. If the company is not in a position to buy those shares back, the investor may want to trade them with another investor.

This seems like a simple idea, but in practice there are some challenges. Without computational trust, a third party needs to facilitate the transaction. This brings in fees, extended processes, and, in general, complication.

At Katipult, we imagine a world where this is a straightforward process with as little interference between the two parties as possible. And we believe that BlockChain technology and its inherent computational trust make this a real possibility.

Secondary Markets with Computational Trust

One of the ways we see computational trust providing a lot of value is the removal of third parties in a transaction process. This disintermediation will see BlockChainmaking markets more efficient by speeding up transaction steps and removing parties who are no longer providing value.

This is true disruption to an established market.

Currently, Katipult is a white-label alternative investment management platform that also provides deal origination. Investment groups use Katipult to raise funds for equity or debt products, and then they report the performance of the investments to their investors through the system.

With the Secondary Markets over BlockChain addition to Katipult, we introduce an engine for minting tokens that represent an investment. In the case of an equity investment represented by shares, the investor is issued as many tokens as they purchased shares when the shares are distributed.

This gives investors a number of BlockChain tokens equal to their number of shares in a company, allowing them to deal confidently with secondary marketplaces.

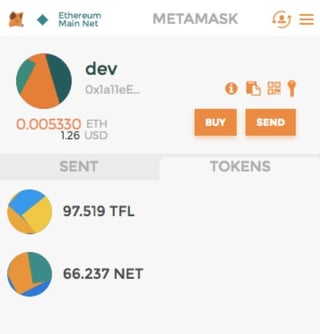

If the investor has an Ethereum wallet connected to the Katipult platform, the shares will be distributed to their wallet, and they will be able to see their shares in their Ethereum wallet.

For instance, in the image above, we show the chrome extension MetaMask. MetaMask is a software that shows an investor how many ERC20 compatible tokens they own. In this case, the investor, “dev,” owns 97.519 shares of TFL and 66.237 shares of NET. TFL or NET could be private securities that dev has invested in and that are tradable through the Katipult platform.

When the investor logs into the Katipult platform, they will be able to know even more detail about their holdings. They will be able to see their holdings and comparison to book cost, the number of this security they’ve bought and sold, any pending transactions, and also what their dividends, interest, or other income look like.

Depending on the private asset that is represented by the token, it may offer an ongoing revenue or a promise of payout at some time in the future. For those that have ongoing revenues, the platform will be able to calculate what those dividends or interest are to be paid and issue those payments to each Ethereum wallet.

Controls

Having a custom smart contract in place allows Katipult to create controls on the marketplace. Some of the rules that are implemented on these contracts include:

- The market may be paused or unpaused

- Only investors who have satisfied KYC / AML can participate

- Fees can be taken from transactions

All of these rules are in place to add security and confidence to the marketplace, while making it easier for Katipult users to issue and understand contracts. We’re committed to creating an investor-friendly platform that solves many of the inherent issues of the traditional secondary market.

Revenue Opportunities

Private Asset groups want this secondary market feature for a number of reasons. First, in sophisticated markets like the UK and Singapore, we see regulators asking for a means to give investors access to liquidity. Second, investors are going to be more willing to buy into a private investment if they know they have a way to get out. Third, this opens up the opportunity for platforms to gain more passive income by collecting transaction feeds on any trades that are conducted.

We believe that our BlockChain-based Secondary Markets platform will do all this.

Further Development

Katipult is developing the Secondary Markets platform as an API; this means that there is the potential for the trading of assets among Katipult platforms and other private security management platforms. This means that Katipult Customer A, Katipult Customer B, and Katipult Customer C could establish a partnership where their investors could trade shares between the investors on their platforms. Further, it means that a platform that isn’t a Katipult platform could also participate in this network.

It also means that platforms that are not currently on Katipult could implement just the API for the Katipult Secondary Markets.

Ready for the Future

Clearly, our Secondary Markets platform will be a powerful, game-changing tool. The security afforded by BlockChain tokens grants our users computational trust - that is, they will be able to trust the technology even if they are unfamiliar with other users or investors. We’ll also be able to have tight control over the marketplace as a whole, ensuring a level playing field for all investors.