DealFlow is the one-stop investment platform to offer alternative investments to high-net-worth clients. Review funds and opportunities and then enter into structured workflows and documentation that will take enable investors to participate in deals with a few clicks of a mouse.

DealFlow offers Finra-regulated representatives the fastest and most efficient way to buy and sell securities for clients. Compliance workflows are baked into the platform, and Katipults eSignature technology ensures fully transparent documentation and KYC checks.

The investor experience is designed around simplicity and ease of use. Investor onboarding smart forms that include real-time documentation checks and streamlined KYC make it quick and frictionless and reduce the potential for errors to almost zero.

Maximize returns by finding private placements and other alternative investments outside of mainstream markets. Participate easily and quickly with workflows created specifically for institutional investors.

Capital Raised

Deals Executed

Investor Accounts Opened

Remove Old Systems

Eliminate cumbersome and costly legacy software

Digitize Manual Processes

Remove frequent human errors and compliance deficiencies

Reduce Compliance Backlog

Streamline compliance workflows to prevent bottlenecks and delays

Accelerate Private Deal Growth

Grow your private deal volume and broaden your distribution channels

Enable Cross-Border Product Placement

Increase your organization connectivity to service international investors

Create Rapid Deal Distribution

Execute deals faster and more efficiently for a better client experience

Execute private capital deals more efficiently with the industry-leading placement engine.

Learn More

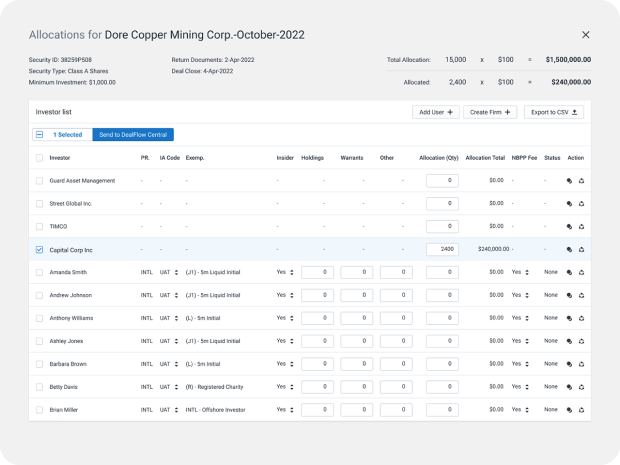

Improve the investor experience by allowing institutions to receive allotments in real-time

Learn More

Distribute deal information, and ensure compliance with an automated workflow.

Learn More

A centralized and highly automated editor for compliance and syndication teams to ensure a compliant, error-free, and streamlined workflow across all distribution channels.

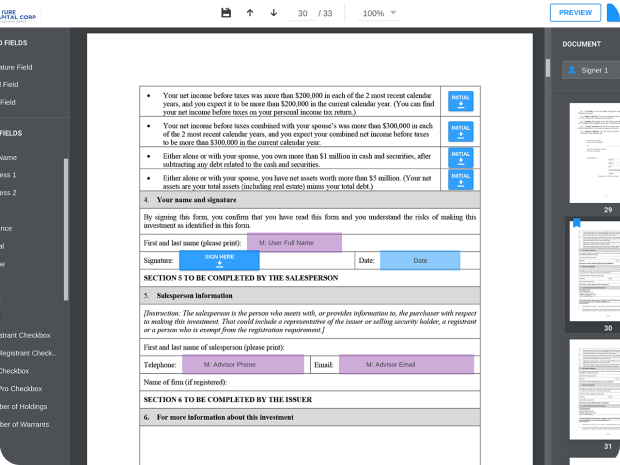

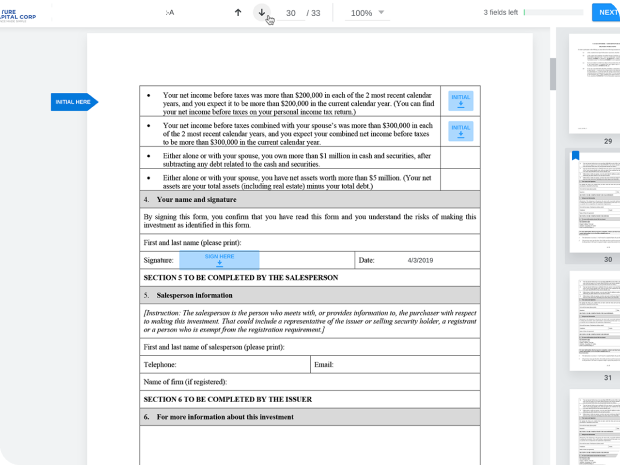

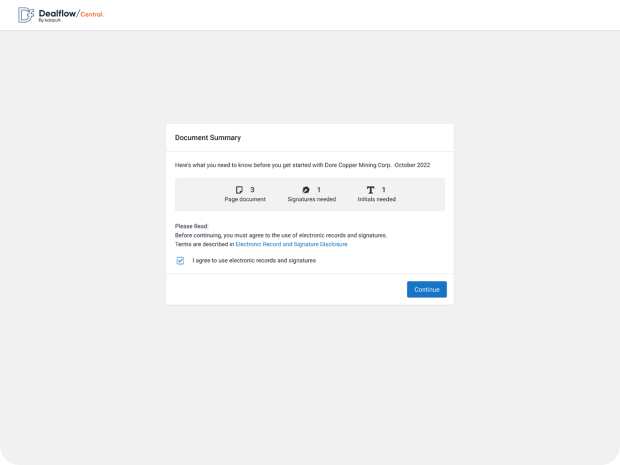

Set up a single PDF copy of the subscription document and have it auto-generated correctly for every investor, in a guided and fully compliant workflow.

Auto-populated documentation with built-in smart logic to provide seamless experiences for investment advisors and investors.

Merge required information automatically into subscription documents and provide a guided workflow for the execution of signatures and initials, specific to each investor.

Multiple Investment Vehicles

Investor Exemptions

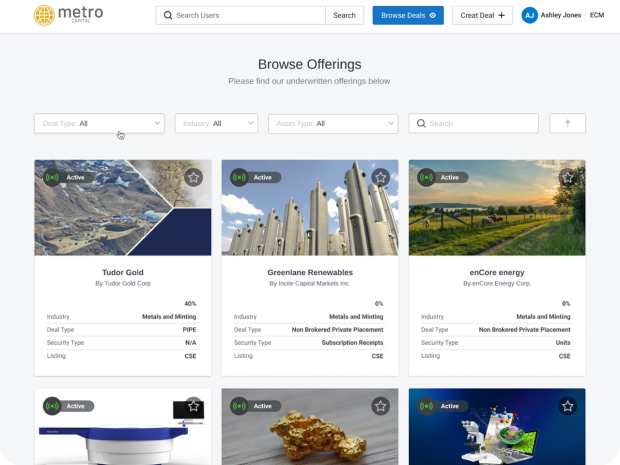

A centralized marketplace to showcase all private placements currently being offered by the firm. Increase awareness and accessibility to all stakeholder groups.

Create highly engaging deal pages for Investment Advisors to perform due diligence, and set up permissions to control which investment advisor teams can access deals.

A highly efficient distribution tool for Investment Advisors to send subscription documents to investors for signature, and ensure error-free document execution.

Assign order allocations and have subscription documents auto-populated for every investor, and emailed for signature in a guided and fully compliant workflow.

Digital distribution and seamless execution of subscription documents using Katipult’s proprietary document generation and electronic signature technology.

Investors can access auto-populated subscription documents via email and simply apply signatures and initials where required.

Katipult expedites REIT fund setup for swift product launch and capital raising. Our customizable deal page layouts empower technical teams for heavy customizations when needed.

Katipult streamlines DST setup, ensuring efficient trust initiation and capital raising. Our platform enables seamless customization and adaptation of deal page layouts, providing flexibility for diverse investment strategies.

Partner with Katipult for technology to manage Qualified Opportunity Zone funds. Eliminate inefficiencies, focusing on delivering institutional-grade opportunities to high-net-worth and retail investors.

Katipult offers a solution for private equity professionals, streamlining the investment cycle and optimizing processes. Our platform provides real-time dashboards reflecting key metrics, empowering your team to efficiently identify opportunities, manage risk, and meet reporting needs.

As your technology partner, Katipult provides an investment platform to offer commercial real estate investments. Operate within regulatory frameworks, eliminating inefficiencies associated with spreadsheets. Focus on delivering institutional-quality opportunities to high-net-worth and retail investors.

Centralize and streamline the investment cycle with Katipult's private equity solutions. Real-time dashboards empower professionals to discover opportunities, manage risk, optimize portfolios, and meet regulatory reporting requirements efficiently.

Reduce time spent on subscription document revision and error correction.

All activity has a footprint that is user-specific and time-stamped for accurate auditing capabilities.

Ensure that the entire staff in each respective division is following compliant processes while also adhering to company and regulatory policies.

Katipult DealFlow is changing the way that capital is raised with efficient and streamlined workflows which enable deals to close in days, not weeks or months.

Get answers to your unique questions, see the investment platform in action and discover why Katipult DealFlow is the right capital markets technology for your business.

900-903 8th Ave SW

Calgary, AB T2P 0P7