"Es wird erwartet, dass liquide Mittel in Höhe von 7T$ im Jahr 2019 von Millenials kontrolliert werden.

Katipult ist in der einzigartigen Position, privaten Kapitalmarktunternehmen zu helfen, die Millennial-Investoren zu erreichen und zu bedienen.

Private Kapitalmärkte leiden unter betrieblichen Unwirtschaftlichkeiten und Komplianzbestimmungen, die ihr Wachstum bremsen. Unser Ziel ist es, Unternehmen zu helfen, die Chancen auf den heutigen Kapitalmärkten zu nutzen, indem sie manuelle Systeme und die Arbeit mit Ad-hoc-Prozessen entfernen sowie Engpässe aufgrund der Abhängigkeit von Schlüsselpersonen beseitigen.

Wir verfolgen die Mission bei Katipult, alle lästigen administrativen Aufgaben zu automatisieren, sicherzustellen, dass alle Arbeitsabläufe grundsätzlich konform sind, sowie dem privaten Kapitalgesellschaften dabei zu helfen, ihre Rentabilität und Vielseitigkeit durch eine vollautomatische, integrierte, zentralisierte und einfach zu bedienende digitale Plattform zu erhöhen.

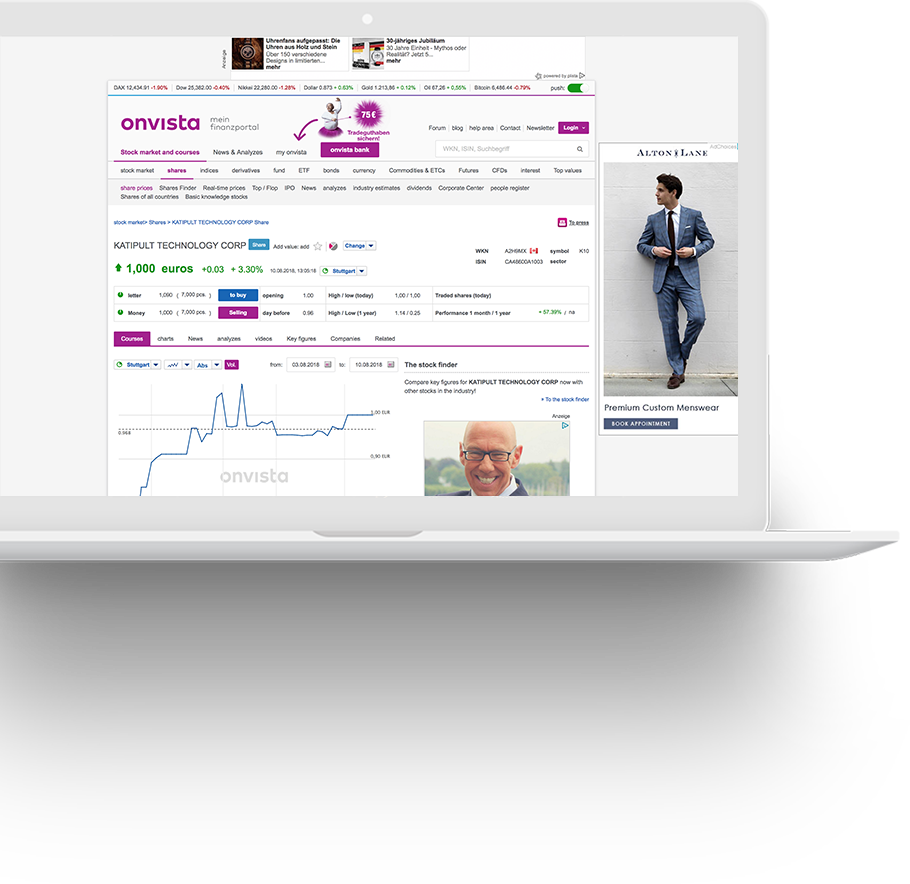

Die Frankfurter Börse ist die größte der sieben regionalen Wertpapierbörsen in Deutschland. Die Aktien der Katipult Technology Corporation werden unter dem Symbol K10 gehandelt.

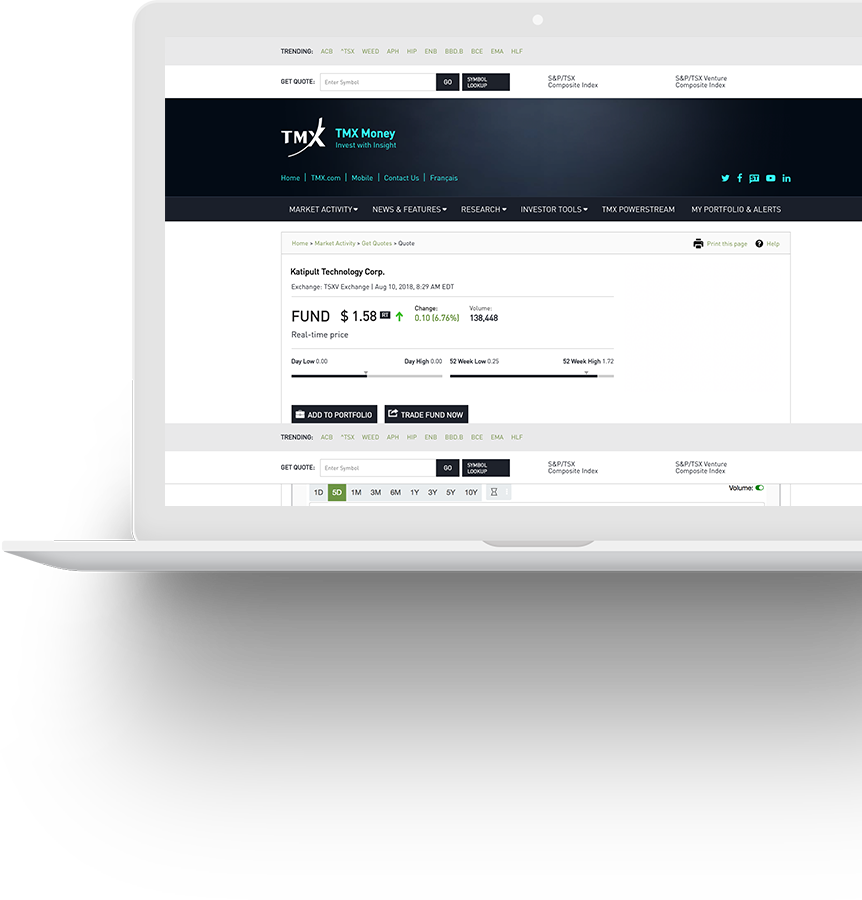

Die TSX Venture Exchange dient als öffentlicher Marktplatz für Risikokapital für aufstrebende Unternehmen, insbesondere in Kanadas Rohstoff- und Technologiebereichen. Katipult Technology Corporation Aktien werden unter dem Symbol FUND und FUND.V. gehandelt.

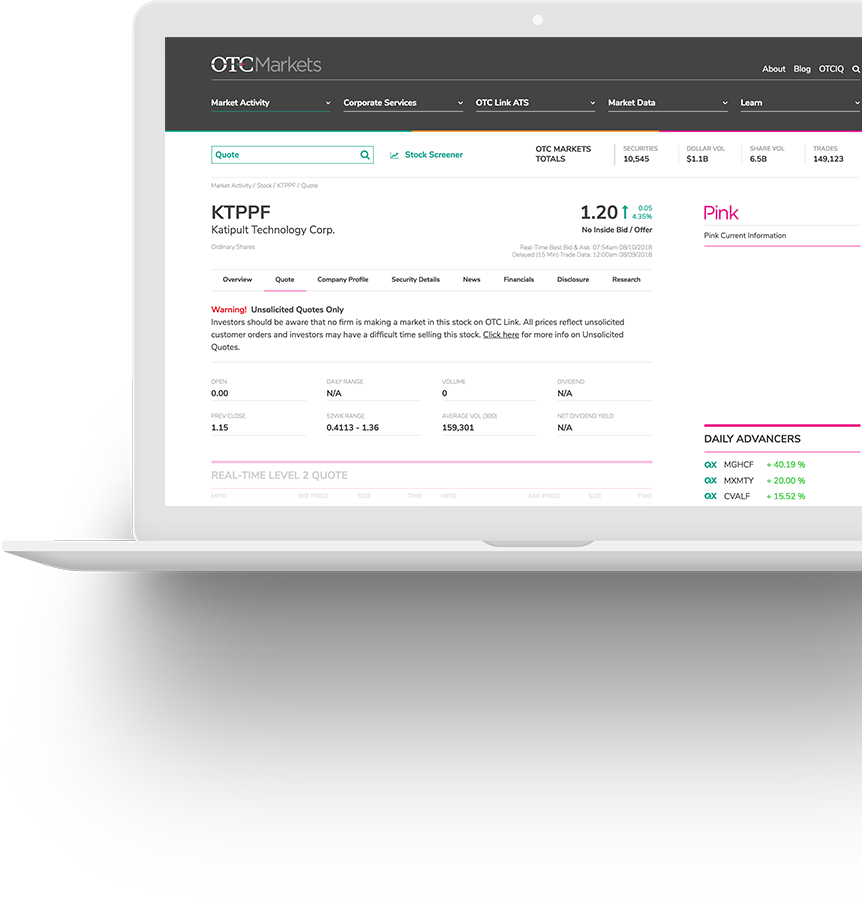

OTC Markets Group, is an American financial market providing price and liquidity information for almost 10,000 over-the-counter securities. The group has its headquarters in New York City. Katipult Technology Corp stock is traded under the symbol KTPPF.

Feb 6, 2024

Accomplished executive, board director, and senior capital markets professional joins Katipult as Strategic Advisor

Jan 16, 2024

Katipult Customer Reliance on Award-Winning DealFlow Platform Drives 55% Increase In Deals

Calgary, AB (January 16th, 2024) - Katipult Technology Corp. (TSXV: FUND) ("Katipult" or the "Corporation"), a leading Fintech provider of software for powering the exchange of capital in equity and debt markets, is pleased to announce that it facilitated over $647 in capital raises during 2023 through its DealFlow platform.

Nov 29, 2023

Subscription revenue which increased by 44.5% to $721,000 in the third quarter of 2023 from $476,000

Calgary, November 28, 2023 - Katipult Technology Corp. (TSXV: FUND) ("Katipult" or the "Corporation"), provider of an industry leading and award-winning cloud-based software infrastructure for powering the exchange of capital in equity and debt markets, is pleased to announce its financial results for the three-month period ended September 30, 2023.

Wir antworten Ihnen in 24 bis 48 Stunden, aber Sie erhalten innerhalb der nächsten 15 Minuten eine Email, wobei sie einen Termin mit unseren Experten vereinbaren können.